🚀 Navigate Boeing’s 2023 Financial Skies Like a Pro! 📊

Boeing 2023 Beginner’s Guide Introduction:

Greetings, future finance leaders! Are you intrigued by the financial mechanisms that keep Boeing soaring in 2023? Take off with “Boeing 2023: Beginner’s Guide to Financial Analysis,” your essential resource from Quality Business Consultant, penned by the finance expert Paul Borosky, MBA. This guide is more than just a primer; it’s your navigational chart to dissecting the financials of one of the aerospace industry’s giants!

Why You’ll Love This Guide:

- Pilot Your Learning with a Finance Expert: 🎓 Fly through Boeing’s 2023 financial data with Paul Borosky, MBA, as your co-pilot, courtesy of Quality Business Consultant.

- Elevated Financial Insights into Boeing: 📉 Gain altitude with a summary of Boeing’s income statements and balance sheets for 2023.

- Master the Financial Gauges: 🧮 Get cockpit-ready by mastering over twenty crucial financial ratios, illuminating Boeing’s fiscal health.

- Demystifying Finance: 📚 Our “In other words” sections convert financial tech talk into clear, actionable insights.

- Strategic Analysis Altitude: 💡 Elevate your analysis with Paul’s expert tips, enhancing your financial perspective in academia or industry.

- In-Depth Analysis Flight Plan: 🔍 For a more detailed journey, our “Financial Analysis & Report” offers a comprehensive review of Boeing, combining AI-driven insights with Paul Borosky’s experienced analysis.

Guide Highlights:

- Legal Disclaimer for a smooth takeoff.

- An engaging Forward to set your flight path.

- Detailed expedition of Income Statements and Balance Sheets for 2023.

- A thorough guide to Financial Ratios, your instruments for financial clarity.

- A cargo hold of financial knowledge awaits!

Table of Contents Sneak Peek:

- Flight through Income Statements: Analyzing revenue, expenses, and beyond

- Balance Sheet Reconnaissance: Scouting assets, liabilities, and equity – the structural integrity of financial analysis

- Financial Ratio Radar: Navigating the metrics to gauge Boeing’s fiscal dynamics

Who’s This For?

Designed for the ambitious business student and the pioneering entrepreneur, this guide is your jet fuel to master financial analysis, with Boeing as your case study.

Board Your Guide:

Ascend your financial analysis capabilities with “Boeing 2023: Beginner’s Guide to Financial Analysis.” Transform complex financial data into your strategic advantage.

Additional Note: This beginner’s guide lays the groundwork for a solid understanding of critical financial concepts, focusing on income statements, balance sheets, and essential financial ratios for their analysis. It concisely presents Boeing’s financials, offering you the specific data, calculations, and ratios for your analytical journey. While the guide equips you with the tools for financial exploration, the detailed analysis is yours to pilot. Our “Financial Analysis & Report” delivers in-depth insights for a comprehensive, company-specific analysis, fusing AI accuracy with Paul Borosky, MBA’s expert scrutiny.

Sincerely, Paul, MBA.

PDF/Downloadable Versions

Click Below for the CURRENT

Downloadable PDF Price!!

Click Below for the CURRENT

Downloadable PDF Price!!

Sample Financial Report

Boeing Company: Brief Summary

The Boeing Company, headquartered in Chicago, Illinois, operates in the aerospace and defense industry within the industrial sector. Led by CEO David Calhoun, the organization boasts around 161,000 employees.

From a financial perspective, Boeing’s stock is currently priced at approximately $185, with a market capitalization of around $102 billion. The 52-week stock range is between $89 and $391, indicating volatility in its trading performance. With a beta of 1.45, Boeing is considered moderately riskier than the overall market.

These financial indicators provide a snapshot of Boeing’s current market valuation and risk profile. They are a starting point for further financial analysis and decision-making, allowing stakeholders to assess the company’s performance and potential investment opportunities.

Boeing Financial Report Sources

The Boeing Financial Report, titled “Boeing 2021 Company Analysis… For Beginners: Financial Statements and Financial Ratios: Defined, Discussed, and Analyzed for 5 Years,” was authored by Paul Borosky, MBA., the owner of Quality Business Plan. The report draws information from various sources, including Boeing’s 2021 10k annual report, 2017 10k annual report, 2016 10k annual report, 2020 10k annual report, and 2019 10k annual report. These financial statements and reports form the foundation of the report’s analysis, providing comprehensive and accurate information about Boeing’s financial performance over five years. By utilizing these reliable sources, the report offers valuable insights into Boeing’s financial statements, key financial ratios, and overall financial analysis.

Section 1: Boeing Income Statement Analyzed

Section 1 delves into the analysis of Boeing’s income statement. The section begins by providing a comprehensive overview of an income statement and highlighting its significance in financial analysis. It defines and discusses various income statement line items, including revenues, gross profits, and other relevant components. Each line item is thoroughly examined and explained in detail, highlighting its importance and contribution to Boeing’s financial performance.

Following each line item’s comprehensive definition and discussion, a summary analysis highlights the significant trends observed in Boeing’s income statement line items. This summary analysis allows readers to gain valuable insights into the company’s revenue generation, profitability, and overall financial health over the specified period. By understanding and analyzing these income statement line items, stakeholders can make informed decisions, assess Boeing’s financial performance, and identify areas for potential improvement or further exploration.

Boeing 2023 Summary Income Statement |

||||||

| Column1 | 2023 | 2022 | 2021 | 2020 | 2019 | |

| Revenues | 77,794 | 66,608 | 62,286 | 58,158 | 76,559 | |

| COGS | 70,070 | 63,078 | 59,237 | 63,800 | 72,031 | |

| Gross Profit | 7,724 | 3,530 | 3,049 | (5,642) | 4,528 | |

| SG&A | 5,168 | 4,187 | 4,157 | 4,817 | 3,909 | |

| Depreciation | 1,861 | 1,979 | 2,144 | 2,246 | 2,271 | |

| R & D | 3,377 | 2,852 | 2,249 | 2,476 | 3,219 | |

| Other | ||||||

| Total Operating Expenses | 70,070 | 63,078 | 59,237 | 63,843 | 72,093 | |

| EBIT | 7,724 | 3,530 | 3,049 | (5,685) | 4,466 | |

| Other Income | ||||||

| Interest Expense | 2,459 | 2,561 | 2,714 | 2,156 | 722 | |

| EBT | (2,005) | (5,022) | (5,033) | (14,476) | (2,259) | |

| Taxes | (237) | (31) | 743 | 2,535 | 1,623 | |

| Net Income | (2,242) | (5,053) | (4,202) | (11,873) | (636) | |

Boeing Revenue Growth.

Boeing’s revenues were $94 billion in 2017. The organization’s revenues would fall in the next four years, ending 2021 at $62.2 billion. The company’s annual average revenue growth was -8.4% for the last five years. This trend indicates that the company struggles to sell its products and services. An essential economic event that may have impacted the firm was Covid-19. From an investor’s perspective, this is a poor trend.

Analyst Grade: D

Importance of Boeing’s Income Statement for Financial Analysis

Boeing’s income statement holds immense importance in financial analysis as it provides a comprehensive overview of the company’s revenue, expenses, and profitability over a specific period. Understanding the significance of Boeing’s income statement is vital for several reasons. Firstly, it allows analysts to evaluate the company’s revenue sources and identify key drivers of growth or decline. This information helps in assessing the effectiveness of Boeing’s business operations and sales strategies. Secondly, the income statement provides insights into the company’s cost structure and expense management, enabling stakeholders to evaluate its efficiency and profitability. Analysts can identify areas of improvement by analyzing trends and changes in revenue and expenses and make informed decisions regarding cost control and resource allocation. Additionally, the income statement is a basis for calculating various financial ratios, such as gross margin and operating margin, which provide insights into Boeing’s profitability and operational efficiency. The income statement is crucial in financial analysis, enabling stakeholders to assess Boeing’s financial performance, make strategic decisions, and monitor its profitability and growth prospects.

Section 2: Boeing Balance Sheet Analyzed

In Section 2, we conduct a detailed analysis of Boeing’s balance sheet. The section comprehensively reviews each significant line item featured in the balance sheet. Each line item, including cash, property, plant and equipment, and liabilities, is thoroughly defined and examined from 2015 to 2019.

This analysis aims to clearly understand the composition and significance of these balance sheet line items. By delving into each item’s definition and implications, readers gain valuable insights into Boeing’s financial position, asset holdings, and liabilities over the specified period.

Furthermore, a summary analysis of these critical balance sheet line items is presented. This summary analysis lets readers grasp Boeing’s balance sheet’s overall trends and patterns, providing valuable information about the company’s liquidity, asset management, and financial stability. Understanding and interpreting these balance sheet line items is essential for comprehensive financial analysis, enabling stakeholders to assess Boeing’s financial health and make informed decisions regarding investment, financing, and strategic planning.

Boeing 2023 Summary Balance Sheet |

|||||

| Column1 | 2023 | 2022 | 2021 | 2020 | 2019 |

| Cash | 12,691 | 14,614 | 8,052 | 7,752 | 9,485 |

| Short Term Investment | 3,274 | 2,606 | 8,192 | 17,838 | 545 |

| Account Receivable | 10,966 | 11,151 | 11,261 | 9,950 | 12,309 |

| Inventory | 79,741 | 78,151 | 78,823 | 81,715 | 76,622 |

| Other | |||||

| Current Assets | 109,275 | 109,523 | 108,666 | 121,642 | 102,229 |

| Net PPE | 10,661 | 10,550 | 10,918 | 11,820 | 12,502 |

| Goodwill | 8,093 | 8,057 | 8,068 | 8,081 | 8,060 |

| Other | |||||

| Total Assets | 137,012 | 137,100 | 138,552 | 152,136 | 133,625 |

| Accounts Payable | 11,964 | 10,200 | 9,261 | 12,928 | 15,553 |

| Accrued Expense | 22,331 | 21,581 | 18,455 | 22,171 | 22,868 |

| Accrued Taxes | |||||

| Notes Payable | 5,204 | 5,190 | 1,296 | 1,693 | 7,340 |

| LT Debt - Current | |||||

| Other | |||||

| Total Current Liabilities | 95,827 | 90,052 | 81,992 | 87,280 | 97,312 |

| LT Debt | 47,103 | 51,811 | 56,806 | 61,890 | 19,962 |

| Other | |||||

| Total Liabilities | 154,240 | 152,948 | 153,398 | 170,211 | 141,925 |

| Common Stock | 15,370 | 15,008 | 14,113 | 12,848 | 11,806 |

| Treasury | 49,549 | 50,814 | 51,861 | 52,641 | 54,914 |

| Retained Earnings | 27,251 | 29,473 | 34,408 | 38,610 | 50,644 |

| Other | |||||

| Total Equity | (17,233) | (15,848) | (14,846) | 18,316 | (8,300) |

| Total Equity & Liability | 137,012 | 137,100 | 138,552 | 152,136 | 133,625 |

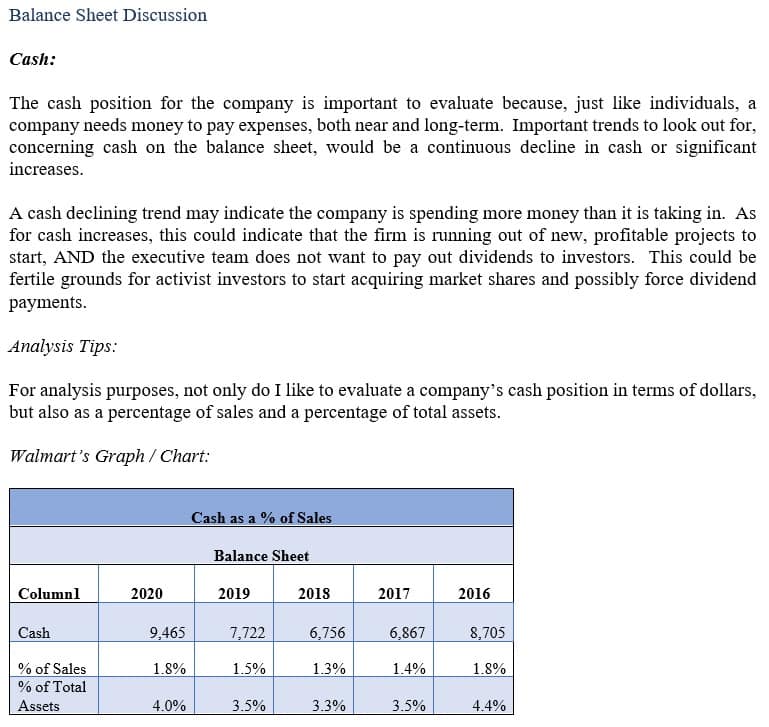

Boeing Cash:

Boeing’s cash holding was $8.8 billion in 2017. As compared to sales, their cash holding was 9.4%. In the next several years, the organization’s cash position would fall slightly to $8 billion or 12.9% of sales in 2021. This trend indicates that the company is holding more cash than sales in the long term. This may mean that the firm does not have much faith in its short-term opportunities for revenue growth. As a result, a higher cash position may be needed in the short to moderate term. From an investor’s perspective, this is a poor trend.

Analyst Grade: C

Importance of Boeing’s Balance Sheet for Financial Analysis

Boeing’s balance sheet is crucial in financial analysis as it provides a snapshot of the company’s financial position at a specific time. Understanding the importance of Boeing’s balance sheet is crucial for several reasons. Firstly, it presents a comprehensive overview of the company’s assets, liabilities, and shareholders’ equity, allowing stakeholders to assess its financial health and stability. The balance sheet helps evaluate Boeing’s liquidity and solvency by examining its ability to meet short-term and long-term obligations.

Secondly, the balance sheet is a foundation for calculating various financial ratios and metrics that provide insights into Boeing’s financial performance and efficiency. These ratios include the debt-to-equity, current, and asset turnover ratios. Such ratios enable stakeholders to analyze Boeing’s leverage, liquidity, and asset utilization, aiding decision-making processes.

Moreover, by comparing balance sheets over multiple periods, analysts can identify trends and changes in essential line items, offering insights into Boeing’s financial strategy and management effectiveness. Overall, the balance sheet is a vital tool for financial analysis, providing valuable information about Boeing’s financial position, liquidity, leverage, and overall stability, which assists stakeholders in making informed decisions and formulating effective business strategies.

Section 3: Boeing Financial Ratios Analyzed

In Section 3, we conduct a comprehensive analysis of various financial ratios for Boeing, covering the period from 2015 to 2019. This selection of financial ratios allows us to gain insights into different aspects of Boeing’s financial performance.

The section begins by clearly defining each financial ratio chosen for analysis. These definitions help readers understand the purpose and significance of each ratio. We then provide the formulas for calculating each ratio, ensuring transparency and clarity in the analysis process. A concise analysis of Boeing’s important financial ratios follows the definition and formula. This analysis allows readers to interpret the ratios in the context of Boeing’s financial performance and industry benchmarks. By examining these ratios, stakeholders can assess Boeing’s profitability, efficiency, leverage, and other key financial metrics.

The analysis of Boeing’s financial ratios aids in understanding the company’s financial health, identifying areas of strength or weakness, and facilitating comparison with industry peers. It provides valuable insights for investors, analysts, and decision-makers to evaluate Boeing’s financial performance and make informed decisions regarding investment, strategic planning, and risk management.

Boeing’s Current Ratio.

Boeing’s current ratio was 1.16 in 2017. In the next four years, the organization’s current ratio will increase to 1.3 in 2021. This trend indicates the organization had enough short-term assets to cover its short-term liabilities for the last 12 months. However, additional cash holdings may be needed because the firm’s revenues are declining. As a result, investors should expect the organization’s current ratio to increase in the short to medium term. From an investor’s perspective, this is a below-average trend.

Analyst Grade: B

Boeing’s Return on Assets.

Boeing’s return on assets (ROA) was 9.1% in 2017. In 2021, it was -3.03%. This trend indicates that the firm is managing/holding too many assets compared to revenues. As a result, the company needs to divest some fixed assets to better align with current and future revenue demands. From an investor’s perspective, this is a poor trend.

Analyst Grade: C

Importance of Boeing’s Financial Ratios for Financial Analysis

Financial ratios play a vital role in Boeing’s financial analysis, providing valuable insights into the company’s performance, efficiency, and financial health.

These ratios serve as key indicators that help evaluate different aspects of Boeing’s operations. Firstly, profitability ratios such as gross profit margin, operating margin, and net profit margin offer an understanding of the company’s ability to generate profits and manage costs. Efficiency ratios, including asset and inventory turnover, assess Boeing’s operational effectiveness and resource utilization. Additionally, financial ratios related to liquidity, such as the current and quick ratios, indicate the company’s ability to meet short-term obligations. Furthermore, debt-to-equity and interest coverage ratios help evaluate Boeing’s financial stability and risk management. By analyzing these ratios over time and benchmarking them against industry peers, stakeholders can make informed decisions about investments, financial planning, and strategic initiatives. Financial ratios are essential in understanding Boeing’s financial performance and aiding in effective decision-making.