🚀 Navigate Ford's 2023 Financial Roads Like a Pro! 📊

Ford 2023 Beginner’s Guide Introduction:

Greetings, future finance wizards! Are you ready to drive through the financial avenues of Ford in 2023? Jump into "Ford 2023: Beginner's Guide to Financial Analysis," presented by Quality Business Consultant and crafted by the financial expert Paul Borosky, MBA. This guide is not just a collection of numbers; it's your comprehensive journey through the fiscal workings of one of the automotive industry's stalwarts!

Why You'll Love This Guide:

- Expert Navigation: 🎓 Let Paul Borosky, MBA, steer you through Ford's 2023 financials, courtesy of Quality Business Consultant.

- Financial Statements Summary 📉 Dive deep into Ford's income statements and balance sheets for 2023, to reveal the company's financial structure.

- Extensive Financial Ratio Analysis: 🧮 Unlock over twenty critical financial ratios to get a full picture of Ford's financial health.

- Simplified Financial Terms: 📚 Our "In other words" segments make complex financial terms easy to understand and engaging.

- Customized Analytical Advice: 💡 Utilize Paul's expert analysis tips to boost your financial analysis skills, valuable for both academic and professional settings.

- In-Depth Insights with Comprehensive Report: 🔍 For a deeper financial understanding, our "Financial Analysis & Report" provides a detailed look at Ford, blending AI insights with Paul Borosky's seasoned analysis.

Guide Highlights:

- An approachable Legal Disclaimer

- A motivating Forward to kickstart your financial journey

- Detailed breakdowns of Income Statements and Balance Sheets for 2023

- In-depth exploration of Financial Ratios to sharpen your analytical abilities

- A full tank of financial knowledge awaits!

Table of Contents Sneak Peek:

- Analyzing Income Statements: Traversing through revenues, expenses, and profitability

- Balance Sheet Insights: Delving into assets, liabilities, and equity – the core components of financial stability

- Mastering Financial Ratios: Gaining the skills to assess Ford's financial performance

Who's This For?

Ideal for keen business students and budding entrepreneurs, this guide is your accelerator in mastering financial analysis with a spotlight on Ford.

Rev Up Your Financial Skills:

Enhance your financial literacy with "Ford 2023: Beginner's Guide to Financial Analysis." Transform the complex world of financial data into strategic insights.

Additional Note: This beginner's guide aims to provide a solid foundation in key financial concepts, concentrating on income statements, balance sheets, and the essential financial ratios for their analysis. It offers a summarized view of Ford's financials, including specific data, calculations, and ratios to guide your analysis. While the guide equips you with the tools for financial exploration, conducting the in-depth analysis is your endeavor. For those seeking a detailed, company-specific financial review, our "Financial Analysis & Report" delivers thorough insights, merging AI accuracy with Paul Borosky, MBA's expert judgment.

Sincerely,

Paul, MBA.

PDF/Downloadable Version

Click Below for the CURRENT

Downloadable PDF Price!!

Click Below for the CURRENT

Downloadable PDF Price!!

Sample Financial Report

Ford Motors: Brief Summary

Ford Motor Company, trading as "F" on the New York Stock Exchange (NYSE), is a prominent player in the auto manufacturing industry. The company is headquartered in Dearborn, Michigan, led by Executive Chairman William Clay Ford Junior and CEO James Hackett. Ford operates within the cyclical consumer sector, manufacturing a range of products that include Ford cars, trucks, and luxury Lincoln brand automobiles. With a global presence, Ford has manufacturing facilities and sales operations in various countries.

Ford employs approximately 190,000 individuals, contributing to its operations and growth. The company's success and financial performance can be assessed through key financial ratios. Profitability ratios, such as gross and net profit margins, offer insights into Ford's ability to generate profits and manage costs effectively. Return on assets (ROA), return on equity (ROE), and return on investment (ROI) measure Ford's efficiency in utilizing its assets and equity to generate returns for shareholders and investors.

Assessing Ford's Financial Performance for Informed Decision-Making and Growth Strategies

Understanding Ford's financial performance and analyzing these ratios over time allows stakeholders to evaluate the company's financial health, profitability, and efficiency. This information aids in making informed investment decisions, benchmarking against industry peers, and developing strategies for sustainable growth. Ford's strong presence in the auto manufacturing industry makes its financial analysis crucial for investors, stakeholders, and management to assess the company's position and make informed decisions.

From a financial perspective, Ford has a market Of approximately $21.5 billion. Their beta is 1.25. This indicates that the company is moderately riskier than the overall market. Ford stock prices fluctuated from $3.98 to $10.56. Their last dividend paid out was January 29 of 2020. In the last four quarters, Ford has missed earnings estimates and three of the last four quarters.

Ford Financial Report Sources

“Ford Motors 2019 Company Analysis… For Beginners: Financial Statements and Financial Ratios: Defined, Discussed, and Analyzed for 5 Years” was written by, Paul Borosky, MBA., and owner of Quality Business Plan. In this report, I used Ford's 2018 10k, Ford's 2017 10k annual report, 2016 10k annual report, 2015 10k annual report, and Ford's 2019 10k annual report as the basis for information gathering.

Section 1: Ford Motors Income Statement Analyzed

In this section, I walk through a broad definition of what an income statement is and why it is important. I then discuss and define income statement line items, such as revenues, gross profits, etc., in detail. After each line item is defined and discussed, I finally offer a summary analysis of Ford's important income statement line item trends from 2015 to 2019, in most cases.

Importance of Understanding Ford’s Income Statement for Financial Analysis

Understanding Ford's income statement is essential for financial analysis, providing crucial insights into the company's revenue, expenses, and overall profitability. The income statement, also known as the profit and loss statement, summarizes Ford's financial performance over a specific period, typically a quarter or a year.

By analyzing the income statement, analysts can evaluate Ford's revenue generation and sales trends to assess the company's market position and product demand. It provides information on various expense categories, such as operating expenses, cost of goods sold, research and development expenses, and selling and administrative expenses. This breakdown helps stakeholders understand Ford's cost structure, cost management strategies, and potential risks to profitability.

Gaining Insights Through Multi-Period Analysis of Ford's Income Statement

Furthermore, the income statement reveals Ford's net income or loss, a key indicator of the company's profitability. It enables the calculation of important profitability ratios, such as gross and net profit margins, which provide insights into Ford's ability to generate profits from its operations and control costs.

Analyzing the income statement over multiple periods helps identify trends, growth patterns, and potential risks or opportunities. It allows for comparisons with industry peers and historical performance, facilitating a comprehensive understanding of Ford's financial health and performance.

Overall, a thorough understanding of Ford's income statement is vital for financial analysis, as it enables investors, stakeholders, and management to assess the company's revenue, expenses, profitability, and overall financial performance. This information aids in making informed investment decisions, evaluating operational efficiency, and formulating strategies for growth and sustainability.

Revenue Growth for Ford Motors:

In 2015, Ford had revenues of approximately $149.5 billion. The firm would grow its revenues to approximately $160.3 billion in the next three years. However, in 2019, revenues fell to $155.9 billion. Ford Motors has enjoyed a moderate revenue growth rate of 1.1% over the last five years. Unfortunately, revenues did slide by almost 3% in the last year. This is quite worrisome, especially since 2019 was a time of economic expansion. From an investor's perspective, quarterly earnings should be monitored to ascertain whether revenues fall for the next year. If this is the case, it may indicate that the company is trending lower with revenues. This may mean reduced net profits or future cost-cutting efforts.

Ford 2023 Summary Income Statement |

||||||

| Column1 | 2023 | 2022 | 2021 | 2020 | 2019 | |

| Revenues | 176,191 | 158,057 | 136,341 | 127,144 | 155,900 | |

| COGS | 150,550 | 134,397 | 114,651 | 112,752 | 134,693 | |

| Gross Profit | 25,641 | 23,660 | 21,690 | 14,392 | 21,207 | |

| SG&A | 10,702 | 10,888 | 11,915 | 10,193 | 11,161 | |

| Depreciation | 7,690 | 7,642 | 7,318 | 8,751 | 9,689 | |

| R & D | - | - | - | - | - | |

| Other | 9,481 | 6,496 | 5,252 | 8,607 | 9,472 | |

| Total Operating Expenses | 27,873 | 25,026 | 24,485 | 27,551 | 30,322 | |

| EBIT | 5,458 | 6,276 | 4,523 | (4,408) | 574 | |

| Other Income | 1,302 | 1,259 | 14,733 | 4,899 | (226) | |

| Interest Expense | 1,302 | 1,259 | 1,803 | 1,649 | 1,020 | |

| EBT | 3,967 | (3,016) | 17,780 | (1,116) | (640) | |

| Taxes | (362) | (864) | (130) | 160 | (724) | |

| Net Income | 4,329 | (2,152) | 17,910 | (1,276) | 84 | |

Section 2: Ford Motors Balance Sheet Analyzed

I again go through each important line item from the balance sheet for Ford Motors balance sheet. In reviewing each line item, I will define Ford's balance sheet line item, such as cash, property, plant and equipment, and liabilities between 2015 to 2019. Next, I then offer a summary analysis of Ford's important balance sheet line items.

Importance of Understanding Ford’s Balance Sheet for Financial Analysis

Understanding Ford's balance sheet is crucial for financial analysis, providing key insights into the company's financial position, liquidity, and overall stability. The balance sheet presents a snapshot of Ford's assets, liabilities, and shareholder's equity at a specific time. Analysts can assess Ford's liquidity and ability to meet short-term obligations by examining the balance sheet. Key metrics such as the current and quick ratios can be derived from the balance sheet, providing insights into the company's short-term financial health and capacity to cover immediate liabilities.

Assessing Ford's Financial Position and Asset Management through the Balance Sheet

The balance sheet also reveals Ford's long-term debt levels, equity structure, and capitalization. This information is crucial for evaluating the company's leverage and solvency, helping stakeholders assess the potential risks and financial stability. Additionally, the balance sheet allows for analyzing Ford's asset composition, such as its inventory levels, property and equipment, and intangible assets. This assists in evaluating the efficiency of asset management and the company's ability to generate returns on invested capital.

Understanding Ford's balance sheet is essential for financial analysis as it provides a comprehensive view of the company's financial health, liquidity, leverage, and asset management. This information enables investors, stakeholders, and management to make informed decisions, assess risks, and formulate strategies for growth and profitability.

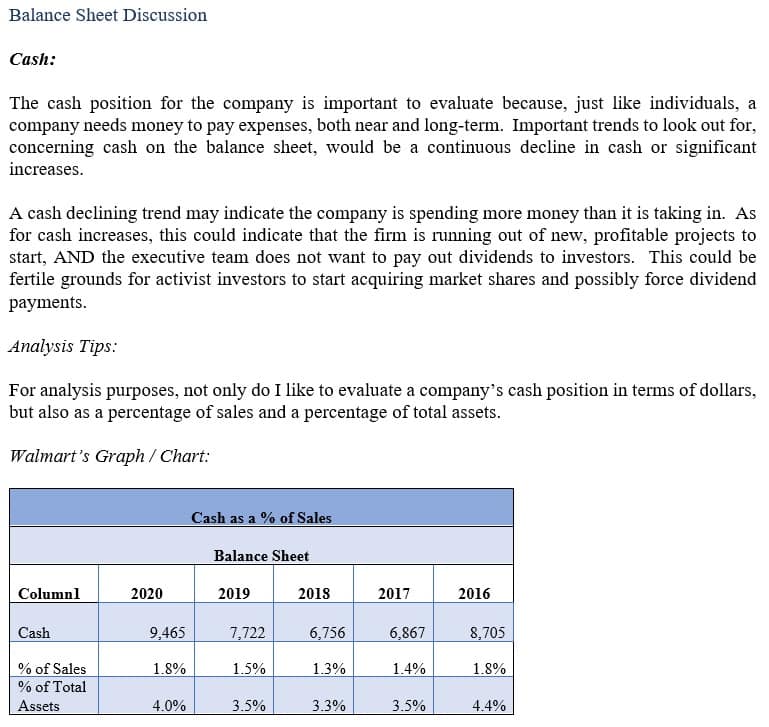

Cash: Ford Motors ended 2015 with $14.2 billion in the bank. The company would increase its cash position to $18.49 billion in the next two years. However, the cash position would fall in 2018 to 16.7 billion, just to rebound in 2019 to $17.5 billion. This trend indicates that the organization built a cash reserve between 2017 and 2015. However, in the last two years, the organization seems to have fluctuated its cash position. This could indicate the company is rebuilding its cash position from 2018 after an acquisition or reducing debt. The cash fluctuation for Ford could also mean that the organization has been restructuring. The restructuring has led to an increase and then a reduction of their cash position.

From an investor perspective, if the cash increases in the next year, then this shows that the firm made some type of internal decision to reduce the cash position substantially and is in the process of rebounding. If the cash position falls, investors should be concerned about Ford's liquidity position.

Ford 2023 Summary Balance Sheet |

||||||

| Column1 | 2023 | 2022 | 2021 | 2020 | 2019 | |

| Cash | 24,862 | 25,134 | 20,540 | 25,243 | 17,504 | |

| Short Term Investment | 15,309 | 18,936 | 29,053 | 24,718 | 17,147 | |

| Account Receivable | 62,026 | 54,449 | 43,913 | 52,394 | 62,888 | |

| Inventory | 15,651 | 14,080 | 12,065 | 10,808 | 10,786 | |

| Other | - | - | - | - | - | |

| Current Assets | 121,481 | 116,476 | 108,996 | 116,744 | 114,047 | |

| Net PPE | 40,821 | 37,265 | 37,139 | 37,083 | 36,469 | |

| Goodwill | - | - | - | - | - | |

| Other | - | - | - | - | - | |

| Total Assets | 273,310 | 255,884 | 257,035 | 267,261 | 258,537 | |

| Accounts Payable | 25,992 | 25,605 | 22,349 | 22,204 | 20,673 | |

| Accrued Expense | - | - | - | - | - | |

| Accrued Taxes | - | - | - | - | - | |

| Notes Payable | 49,669 | 50,164 | 49,692 | 51,343 | 53,946 | |

| LT Debt - Current | - | - | - | - | - | |

| Other | - | - | - | - | - | |

| Total Current Liabilities | 101,531 | 96,866 | 90,727 | 97,192 | 98,132 | |

| LT Debt | 99,562 | 88,805 | 88,400 | 110,341 | 101,361 | |

| Other | - | - | - | - | ||

| Total Liabilities | 230,512 | 212,717 | 208,413 | 236,450 | 225,307 | |

| Common Stock | 23,170 | 22,874 | 22,652 | 22,205 | 22,205 | |

| Treasury | 2,384 | 2,047 | 1,563 | 1,590 | 1,613 | |

| Retained Earnings | 31,029 | 31,754 | 35,769 | 18,243 | 20,320 | |

| Other | - | - | - | - | - | |

| Total Equity | 42,798 | 43,167 | 48,622 | 30,811 | 33,230 | |

| Total Equity & Liability | 273,310 | 255,884 | 257,035 | 267,261 | 258,537 | |

Section 3: Ford Motors Financial Ratios Analyzed

For this section, I have chosen several different financial ratios to review Ford Motors from 2015 to 2019. In reviewing each of Ford's financial ratios, I first start with defining the financial ratio. Next, I supply the financial formula for calculating the specific ratio. Finally, I offer a brief analysis of Ford's Important Financial ratios.

Importance of Understanding Ford’s Financial Ratios for Financial Analysis

Understanding Ford's financial ratios is crucial for financial analysis as they provide valuable insights into the company's performance, profitability, efficiency, and overall financial health. Financial ratios allow analysts to assess Ford's financial position by comparing and evaluating various aspects of its financial statements.

Profitability ratios, such as gross and net profit margins, reveal Ford's ability to generate profits from its operations. These ratios provide insights into the company's pricing strategy, cost management, and profitability.

Analyzing Ford's Financial Ratios: Insights for Liquidity, Leverage, and Efficiency

Liquidity ratios, such as the current and quick ratios, assess Ford's ability to meet its short-term obligations and manage its working capital effectively. These ratios indicate the company's liquidity position and capacity to handle unexpected financial challenges.

Additionally, leverage ratios, such as the debt-to-equity ratio, measure the proportion of debt financing in Ford's capital structure. They provide insights into the company's financial leverage and ability to meet long-term obligations.

Furthermore, efficiency ratios, such as asset and inventory turnover, evaluate how effectively Ford utilizes its assets to generate sales and manage inventory.

Analysts can identify trends, strengths, weaknesses, and areas for improvement within Ford's financial performance by analyzing these financial ratios and comparing them with industry benchmarks or competitors. This information is valuable for investors, stakeholders, and management to assess the company's financial health, make informed investment decisions, and formulate strategies for growth and sustainability.

Ford's Current Ratio:

In 2015, Ford Motor's current ratio was 1.92. The gold standard for the current ratio is 1.0. This indicates that the company has substantially more current assets than operations needs. From this, the organization should reduce its current ratio to approximately 1.0. In the next four years, the organization would do exactly this. Between 2016 and 2019, the current ratio fluctuated between 1.23 and 1.16, which was 2019. This shows that the organization has taken steps to utilize its current assets better.

Ford's Total Asset Turnover:

Ford ended 2015 with a total asset turnover of approximately .66. In the next four years. Their total asset turnover would fall to .60 in 2019. This shows that the organization is underutilizing and continuing to utilize its total assets less year-over-year. To mitigate this problem, the organization must divest some of its assets, mostly fixed assets, to better align with its projected sales.

Ford's Return on Assets:

As for profitability ratios, its return on assets ended 2015 at 3.28%. The company would fluctuate between 2.96% in 2015 and 1.94% in 2016 in the next two years. Unfortunately, in 2018 and 2019, the return on assets fell to 1.44% and .03%, respectively. This means that the company made three cents for every dollar of assets. For a manufacturer, this is a terrible position. The organization needs to divest from some of its fixed assets to optimize better total assets controlled—shame on management.

Ford's Debt Ratio:

Ford Motor’s debt ratio ended 2015 at 53.4%. The next year, the organization would drop its debt ratio to 39.2%. In subsequent years, the firm would hold a solid 39% debt ratio, give or take a few basis points. From an investor’s perspective, the company is doing an excellent job of keeping its debt low. This shows that the company is well-positioned to write out recessionary times. However, with interest rates being at historic lows, this also means that the company is missing out on opportunities to use debt for growth or research and development. As a shareholder, I would expect the latter compared to the former.