🚀 Decode Netflix’s 2023 Financial Plot Like a Pro! 📊

Netflix 2023 Beginner’s Guide Introduction:

Hey there, future financial maestros! Curious to unravel Netflix’s financial storyline in 2023? Embark on a journey with “Netflix 2023: Beginner’s Guide to Financial Analysis,” presented by Quality Business Consultant and authored by the finance sage Paul Borosky, MBA. This isn’t just any finance guide; it’s your all-access pass to the fiscal dynamics of one of the streaming world’s leading players!

Why You’ll Love This Guide:

- Insights from a Finance Virtuoso: 🎓 Let Paul Borosky, MBA, be your guide through the financial intricacies of Netflix in 2023, courtesy of Quality Business Consultant.

- Comprehensive Financial Ratios: 🧮 Master over twenty critical financial ratios to understand Netflix’s financial health clearly.

- Finance Made Accessible: 📚 Tackle financial jargon head-on with our “In other words” sections, making complex concepts easy to grasp.

- Expert Analysis Techniques: 💡 Gain from Paul’s analysis tips to sharpen your financial acumen, applicable in classrooms or boardrooms.

- Extended Insights Offered: 🔍 Delve deeper with our “Financial Analysis & Report,” providing an exhaustive financial analysis of Netflix, merging AI insights with Paul Borosky’s expert review.

Guide Highlights:

- An inviting Legal Disclaimer

- A compelling Forward to kickstart your financial exploration

- In-depth analyses of Income Statements and Balance Sheets for 2023

- An elaborate exploration of Financial Ratios, empowering your analytical journey

- An abundance of financial knowledge at your fingertips!

Table of Contents Sneak Peek:

- Navigating Income Statements: Dissecting revenues, expenses, and more

- Balance Sheet Examination: Unpacking assets, liabilities, and equity – the core of financial storytelling

- Unveiling Financial Ratios: Equipping you with the skills to scrutinize Netflix’s financial pulse

Who’s This For?

Perfect for the eager business student or the aspiring entrepreneur, this guide is your trusty sidekick in mastering financial analysis, with Netflix as your case study.

Secure Your Copy:

Upgrade your finance skills with “Netflix 2023: Beginner’s Guide to Financial Analysis.” Turn the world of financial statements into your strategic playground.

Additional Note: This beginner’s guide is crafted to provide a foundational grasp of essential financial topics, focusing on income statements, balance sheets, and the crucial financial ratios for their analysis. It presents a summarized overview of Netflix’s financials, offering specific data, calculations, and ratios for your analysis. While the guide equips you with analytical tools, the in-depth exploration is yours. Our “Financial Analysis & Report” delivers meticulous insights, integrating AI precision with Paul Borosky, MBA’s seasoned expertise for those seeking a comprehensive, company-specific financial narrative.

Sincerely,

Paul, MBA.

PDF/Downloadable Versions

Click Below for the CURRENT

Downloadable PDF Price!!

Click Below for the CURRENT

Downloadable PDF Price!!

Sample Financial Report

Netflix: Brief Summary

Netflix headquarters is located in Los Gatos, CA. The company competes in the communications services sector—specifically, the entertainment industry. At present, the organization employs approximately 9,400 individuals. Netflix’s main revenue generator is the sale of monthly subscriptions to its movie streaming services. A secondary revenue generator for the firm is the rental of DVDs.

From a financial perspective, Netflix’s market capitalization is about $242 billion as of August 2021. Their beta is .75. This indicates that the company’s stock is slightly less risky than the overall market. Their stock price range for the last 52 weeks has been between $458.60 to $593.29. In the last year, the company has not paid out dividends. This indicates that the firm is still in an expansionary business cycle.

Netflix Financial Report Sources

“Netflix 2020 Company Analysis: Financial Statements and Financial Ratios: Defined, Discussed, and Analyzed for 5 Years” was written by Paul Borosky, MBA, owner of Quality Business Plan. In this book, the author selected Netflix’s 2020 10k, 2017 10k annual report, 2016 10k annual report, 2018 10k annual report, and 2019 10k annual report as the basis for information gathering.

Section 1: Netflix Income Statement Analyzed

This section provides a broad definition of an income statement and its importance. I then discuss and define income statement line items, such as revenues, gross profits, etc., in detail. After each line item is defined and discussed, I finally offer a summary analysis of Netflix’s significant income statement line item trends from 2016 to 2020.

Netflix Revenue Growth:

Netflix’s average annual revenue growth rate over the last five years was approximately 26.4%. However, the firm’s growth rate has continuously declined over these five years. Specifically, in 2018, the organization’s revenue growth was 35.1%. As of 2021, the firm’s revenue growth was 18.8% from the previous year. This decline indicates that the organization may enter a more mature business cycle phase. From this, continued revenue declines should be expected. From an investor’s perspective, this is a below-average trend.

Analyst Grade: B

Netflix 2023 Summary Income Statement |

||||||

| Column1 | 2023 | 2022 | 2021 | 2020 | 2019 | |

| Revenues | 33,723,297 | 31,615,550 | 29,697,844 | 24,996,056 | 20,156,447 | |

| COGS | 19,715,368 | 19,168,285 | 17,332,683 | 15,276,319 | 12,440,213 | |

| Gross Profit | 14,007,929 | 12,447,265 | 12,365,161 | 9,719,737 | 7,716,234 | |

| SG&A | 1,720,285 | 1,572,891 | 1,351,621 | 1,076,486 | 914,369 | |

| Depreciation | 356,947 | 336,682 | 208,412 | 115,710 | 103,579 | |

| R & D | 2,675,758 | 2,711,041 | 2,273,885 | 1,829,600 | 1,545,149 | |

| Other | - | - | - | - | - | |

| Total Operating Expenses | 4,752,990 | 4,620,614 | 3,833,918 | 3,021,796 | 2,563,097 | |

| EBIT | 6,954,003 | 5,632,831 | 6,194,509 | 4,585,289 | 2,604,254 | |

| Other Income | - | - | - | - | ||

| Interest Expense | 699,826 | 706,212 | 765,620 | 767,499 | 626,023 | |

| EBT | 6,205,405 | 5,263,929 | 5,840,103 | 3,199,349 | 2,062,231 | |

| Taxes | 797,415 | 772,005 | 723,875 | 437,954 | 195,315 | |

| Net Income | 5,407,990 | 4,491,924 | 5,116,228 | 2,761,395 | 1,866,916 | |

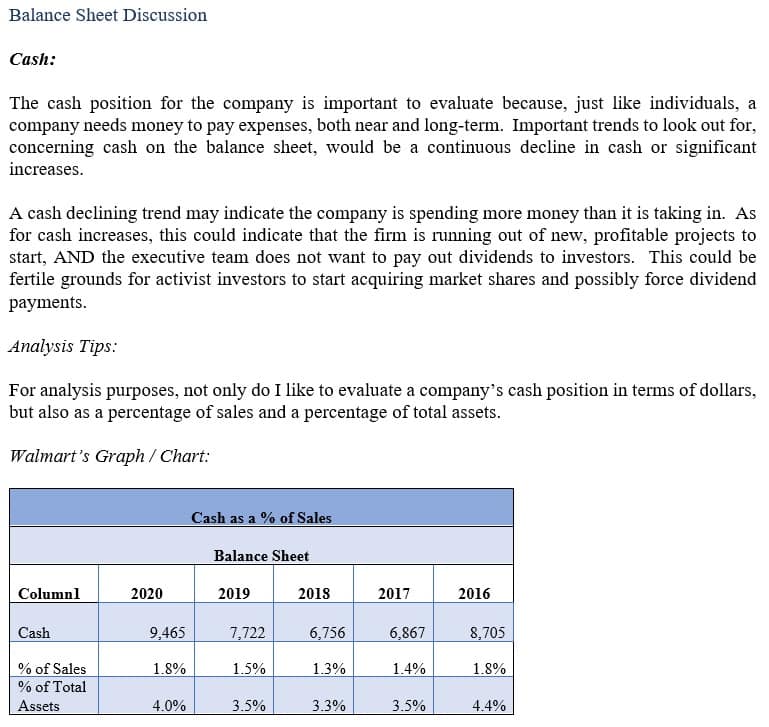

Section 2: Netflix Balance Sheet Analyzed

I again reviewed each vital line item on Netflix’s balance sheet. I will define Netflix’s balance sheet line items, such as cash, property, plant and equipment, and liabilities, between 2016 and 2020. Next, I will summarize Netflix’s essential balance sheet line items.

Netflix Cash.

Netflix’s cash position was $2.8 billion in 2017. Over the next four years, the organization’s cash position would increase substantially, ending 2021 at $6 billion. The organization’s cash percentage was 24.1% compared to sales in 2017. In 2021, the cash, as compared to the sales, dropped to 20.3%. This shows that the firm is holding less cash than it did during this period. From an investor’s perspective, this is a good trend. This shows that the company is not sitting idle on access cash.

Analyst Grade: A

Netflix 2023 Summary Balance Sheet |

|||||

| Column1 | 2023 | 2022 | 2021 | 2020 | 2019 |

| Cash | 7,116,913 | 5,147,176 | 6,027,804 | 8,205,550 | 5,018,437 |

| Short Term Investment | 20,973 | 911,276 | - | - | - |

| Account Receivable | - | - | - | - | - |

| Inventory | - | - | - | - | - |

| Other | - | - | - | - | - |

| Current Assets | 9,918,133 | 9,266,473 | 8,069,825 | 9,761,580 | 6,178,504 |

| Net PPE | 1,491,444 | 1,398,257 | 1,323,453 | 960,183 | 565,221 |

| Goodwill | - | - | - | - | - |

| Other | - | - | - | - | - |

| Total Assets | 48,731,992 | 48,594,768 | 44,584,663 | 39,280,359 | 33,975,712 |

| Accounts Payable | 747,412 | 671,513 | 837,483 | 656,183 | 674,347 |

| Accrued Expense | 1,803,960 | 1,514,650 | 1,449,351 | 1,102,196 | 843,043 |

| Accrued Taxes | - | - | - | - | - |

| Notes Payable | - | - | 699,823 | 499,878 | - |

| LT Debt - Current | - | - | - | - | - |

| Other | - | - | - | - | - |

| Total Current Liabilities | 8,860,655 | 7,930,974 | 8,488,966 | 7,805,785 | 6,855,696 |

| LT Debt | 14,143,417 | 14,353,076 | 14,693,072 | 15,809,095 | 14,759,260 |

| Other | - | - | - | - | - |

| Total Liabilities | 28,143,679 | 27,817,367 | 28,735,415 | 28,215,119 | 26,393,555 |

| Common Stock | 5,145,172 | 4,637,601 | 4,024,561 | 3,447,698 | 2,793,929 |

| Treasury | 6,922,200 | 824,190 | 824,190 | - | - |

| Retained Earnings | 22,589,286 | 17,181,296 | 12,689,372 | 7,473,144 | 4,811,749 |

| Other | - | - | - | - | - |

| Total Equity | 20,588,313 | 20,777,401 | 15,849,248 | 11,065,240 | 7,582,157 |

| Total Equity & Liability | 48,731,992 | 48,594,768 | 44,584,663 | 39,280,359 | 33,975,712 |

Section 3: Netflix Financial Ratios Analyzed

For this section, I have chosen several different financial ratios for Netflix from 2016 to 2020. I start by defining each financial ratio. Next, I supply the financial formula for calculating the specific ratio. Finally, I offer a brief analysis of Netflix’s Important Financial ratios.

Netflix Current Ratio

Netflix’s current ratio was 1.0 in 2017. In the next several years, it will fall slightly to .95. The reduction in the current ratio, primarily since the organization generates cash continuously, should be well received by investors. It shows that the firm is able to cover its current liabilities with less cash and other current assets on hand.

Analyst Grade: A

Netflix Total Asset Turnover

Netflix’s total asset turnover was .61 in 2017. Over the next several years, the firm’s total asset turnover would increase slightly to .67. This trend indicates that the firm is doing a slightly better job using assets under management to generate revenues. However, because of the slow growth in this area, investors should be wary when the organization increases its property, plant, and equipment category faster than sales. From an investor’s perspective, this trend is above average.

Analyst Grade: B