🚀 Electrify Your Knowledge with Tesla's 2023 Financial Insights! 📊

Tesla 2023 Beginner’s Guide Introduction:

Greetings, future financial trailblazers! Are you charged up to explore the financial currents powering Tesla in 2023? Plug into "Tesla 2023: Beginner's Guide to Financial Analysis," presented by Quality Business Consultant and authored by finance maven Paul Borosky, MBA. This guide is more than just a collection of figures; it's a comprehensive circuit to understanding the financial voltage behind one of the electric vehicle industry's pioneers!

Why You'll Love This Guide:

- Steered by a Finance Specialist: 🎓 Navigate Tesla's 2023 financial pathways with Paul Borosky, MBA, your guide from Quality Business Consultant.

- Intensive Financial Examination of Tesla: 📉 Review Tesla's income statements and balance sheets for 2023, illuminating the company's financial framework.

- Thorough Financial Ratio Dissection: 🧮 Analyze over twenty key financial ratios to gauge Tesla's economic energy and sustainability.

- Simplifying Financial Concepts: 📚 Our "In other words" sections convert intricate financial terms into accessible, engaging knowledge.

- Tailored Analytical Strategies: 💡 Utilize Paul's bespoke tips to supercharge your financial analysis capabilities, suitable for both academic and professional environments.

- Enhanced Analysis with In-Depth Report: 🔍 Go further with our "Financial Analysis & Report" for a detailed electrical blueprint of Tesla, combining AI-enhanced insights with Paul Borosky's expert oversight.

Guide Highlights:

- A user-friendly Legal Disclaimer.

- A compelling Forward to jumpstart your financial journey.

- Detailed analyses of Income Statements and Balance Sheets for 2023.

- Extensive coverage of Financial Ratios to boost your analytical prowess.

- A repository of financial knowledge awaits your discovery!

Table of Contents Sneak Peek:

- Income Statement Exploration: Delving into revenues, expenses, and beyond

- Balance Sheet Analysis: Unpacking assets, liabilities, and equity – the core of financial robustness

- Financial Ratios Unveiled: Empowering you with the acumen to scrutinize Tesla's financial health

Who's This For?

Ideal for the energetic business student or the aspiring entrepreneur, this guide is your accelerator in mastering financial analysis with a focus on Tesla.

Grab Your Guide:

Supercharge your financial literacy with "Tesla 2023: Beginner's Guide to Financial Analysis." Transform daunting financial data into your strategic advantage.

Additional Note: This beginner's guide lays the groundwork for understanding essential financial concepts, focusing on income statements, balance sheets, and critical financial ratios for their analysis. It provides a summarized depiction of Tesla's financials, complete with specific data, calculations, and ratios to guide your analysis. While the guide offers the tools for financial exploration, the in-depth investigation is your venture. For those seeking a comprehensive, company-specific financial deep dive, our "Financial Analysis & Report" delivers meticulous insights, blending AI technology with Paul Borosky, MBA's seasoned expertise.

PDF/Downloadable Versions

Click Below for the CURRENT

Downloadable PDF Price!!

Click Below for the CURRENT

Downloadable PDF Price!!

Sample Financial Report

Tesla: Brief Summary

Tesla Inc. has its global headquarters in Palo Alto, CA. The company competes in the auto manufacturing industry, specifically in the cyclical consumer sector. At present, the company employs approximately 70,000 people. Tesla’s main revenue generator is the design, development, and leasing of electric vehicles, as well as energy generation and storage devices.

From a financial perspective, the company has a market capitalization of $580 billion. The company has a beta of 2.0. This indicates to investors that the company stock is substantially riskier as compared to the overall market. In the last several years, Tesla has yet to pay any dividends. This means that the firm is continually finding ways to re-invest its profits. As for the stock price range, in the last 52 weeks, the organization’s stock was between $187.43 to $900.40.

Section 1: Tesla Income Statement Analyzed

In this section, I walk through a broad definition of what an income statement is and why it is important. From this, I then discuss and define income statement line items, such as revenues, gross profits, etc. in detail. After each line item is defined and discussed, I finally offer a summary analysis of Tesla's important income statement line item trends from 2016 to 2020, in most cases.

Tesla Revenue Growth.

In the last five years, Tesla’s revenues have grown annually, on average, at a 49% rate. For a multinational organization, this annual growth rate is astounding. However, a concerning trend for the organization’s revenue growth rate is that it has been haphazard. For example, between 2017 and 2018, the firm’s growth rate was 82.5%. Also, between 2020 and 2021, the organization’s growth rate was 70.7%. However, from 2018 to 2019, the firm’s growth rate was only 14.5%. A better strategy would be for the organization to implement operational strategies to ensure consistent revenue growth year over year.

Analyst Grade: A

Tesla 2023 Summary Income Statement |

|||||

| Column1 | 2023 | 2022 | 2021 | 2020 | 2019 |

| Revenues | 96,773 | 81,462 | 53,823 | 31,536 | 24,578 |

| COGS | 79,113 | 60,609 | 40,217 | 24,906 | 20,509 |

| Gross Profit | 17,660 | 20,853 | 13,606 | 6,630 | 4,069 |

| SG&A | 4,800 | 3,946 | 4,517 | 3,145 | 2,646 |

| Depreciation | 4,667 | 3,747 | 2,911 | 2,322 | 2,154 |

| R & D | 3,969 | 3,075 | 2,593 | 1,491 | 1,343 |

| Other | |||||

| Total Operating Expenses | 8,769 | 7,197 | 7,083 | 4,636 | 4,138 |

| EBIT | 8,891 | 13,656 | 6,523 | 1,994 | (69) |

| Other Income | |||||

| Interest Expense | (156) | (191) | (371) | (748) | (685) |

| EBT | 9,973 | 13,719 | 6,343 | 1,154 | (665) |

| Taxes | (5,001) | 1,132 | 699 | 292 | 110 |

| Net Income | 14,974 | 12,587 | 5,644 | 862 | (775) |

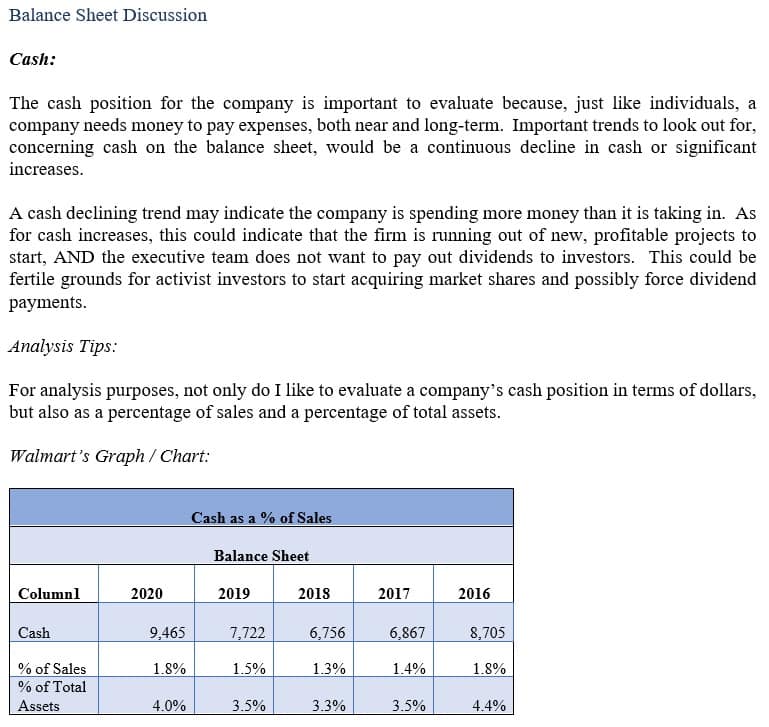

Section 2: Tesla Balance Sheet Analyzed

For Tesla's balance sheet, I again go through each important line item from the balance sheet. In reviewing each line item, I will define their balance sheets line items, such as cash, property, plant and equipment, and liabilities. Next, I then offer a summary analysis of their important balance sheet line items.

Tesla Cash.

Tesla’s cash position ended 2017 at $3.3 billion. In the next two years, the organization’s cash balance would increase moderately, ending 2019 at $6.2 billion. However, in the next year, the firm’s cash position would balloon to $19.3 billion. This cash increase may be due to the onset of the COVID-19 pandemic and the organization’s wish to have a substantial cash buffer through the pandemic. However, the organization’s cash balance remained elevated in 2021, ending the year at $17.5 billion.

A better strategy would be for the firm to divest some of the cash into short-term investments or reinvest the funds into operational growth opportunities. In my opinion, this shows the mismanagement of short-term assets.

Analyst Grade: C

Tesla 2023 Summary Balance Sheet |

||||||

| Column1 | 2023 | 2022 | 2021 | 2020 | 2019 | |

| Cash | 16,398 | 16,253 | 17,576 | 19,384 | 6,268 | |

| Short Term Investment | 12,696 | 5,932 | 131 | - | - | |

| Account Receivable | 3,508 | 2,952 | 1,913 | 1,886 | 1,324 | |

| Inventory | 13,626 | 12,839 | 5,757 | 4,101 | 3,552 | |

| Other | ||||||

| Current Assets | 49,616 | 40,917 | 27,100 | 26,717 | 12,103 | |

| Net PPE | 29,725 | 23,548 | 18,884 | 12,747 | 10,396 | |

| Goodwill | 253 | 194 | 200 | 207 | 198 | |

| Other | ||||||

| Total Assets | 106,618 | 82,338 | 62,131 | 52,148 | 34,309 | |

| Accounts Payable | 14,431 | 15,255 | 10,025 | 6,051 | 3,771 | |

| Accrued Expense | 9,080 | 8,205 | 5,719 | 3,855 | 2,905 | |

| Accrued Taxes | ||||||

| Notes Payable | ||||||

| LT Debt - Current | 2,373 | 1,502 | 1,589 | 2,132 | 1,785 | |

| Other | ||||||

| Total Current Liabilities | 28,748 | 26,709 | 19,705 | 14,248 | 10,667 | |

| LT Debt | 2,857 | 1,597 | 5,245 | 9,556 | 11,634 | |

| Other | ||||||

| Total Liabilities | 43,009 | 36,440 | 30,548 | 28,418 | 26,199 | |

| Common Stock | 34,895 | 32,180 | 29,803 | 27,260 | 12,737 | |

| Treasury | ||||||

| Retained Earnings | 27,882 | 12,885 | 331 | (5,399) | (6,083) | |

| Other | ||||||

| Total Equity | 62,634 | 44,704 | 30,189 | 22,225 | 6,618 | |

| Total Equity & Liability | 106,618 | 82,338 | 62,131 | 52,148 | 34,309 | |

Section 3: Tesla Financial Ratios Analyzed

For this section, I have chosen several different financial ratios to review for Tesla. In reviewing each of their financial ratios, I first start with defining the financial ratio. Next, I supply the financial formula for calculating the specific ratio. Finally, I offer a brief analysis of their important Financial ratios.

Tesla Total Asset Turnover.

Tesla’s total asset turnover ending 2017 was .4. In the next four years, the organization’s total asset turnover would increase to .87 in 2021. This shows that the firm is generating more revenues using assets under management on a continuous basis. Operationally speaking, this is a good trend.

Analyst Grade: A

Tesla Return on Assets.

Tesla’s return on assets ended 2020 at 1.65%. In the next year, the organization’s return on assets would jump up to 9.08%. The substantial growth trend should continue into the foreseeable future due to the firm’s revenue growth rate track record as well as its ability to control costs.

Analyst Grade: A