Business Plan Writer | Indianapolis, IN.

Your CEO Partner — the behind-the-scenes force that makes CEOs stronger, sharper, and more effective

Call or text Dr. Paul at (321) 948-9588

Workplace culture challenges challenges are a common and often overlooked problem that can be addressed in a business plan for small businesses in Indianapolis. These issues are especially prevalent in manufacturing businesses, such as those located in Park Fletcher and other industrial parks near the Indianapolis International Airport.

To mitigate this issue and many others, Dr. Paul Borosky, MBA, business plan writer, recommends focusing on the job description section of the business plan. In this section, business plan writers can provide detailed descriptions for each role, clearly setting expectations for job performance. This approach also helps ensure that qualified individuals are hired. Establishing this clarity is often the first step in turning around company culture and improving accountability. This is just one of many reasons to have a professionally written business plan.

Professional Writing Services

Indianapolis is built on dependable growth. Planning turns that reliability into predictable revenue.

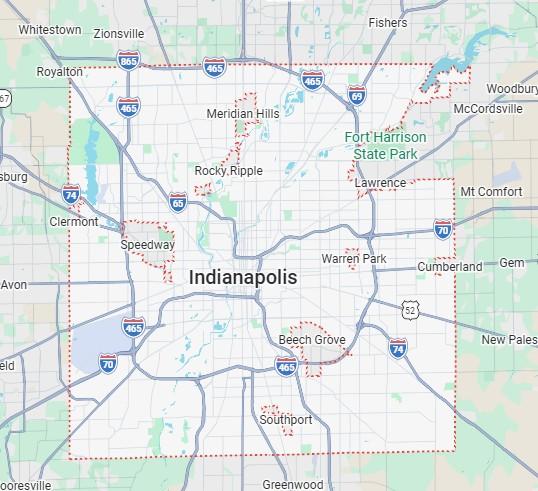

Indiana Business Plan Writer Region: Indianapolis

What You Get - What We Do...

Business Plan Writer Process

- Choose a business plan package (Express, Traditional, Advanced)

- Complete our questionnaire

- Initial Meeting

- Approve the scope of work/Final Payment

- Plan is ready in 7 days - Guaranteed!*

Proven Results

-

Retail pharmacy in Louisville, KY – $280k funding-ready plan.

-

Massage spa in Columbus, OH – $210k funding-ready plan.

-

Solar installation in Sacramento, CA – $950k funding-ready plan.

-

Towing service in Birmingham, AL – $180k funding-ready plan.

-

Barbershop in Detroit, MI – $95k funding-ready plan.

Ready to Stand Out in Indianapolis's Competitive Market?

Text or Call Dr. Paul Today - 321-948-9588

Small Business Opportunities in Indianapolis

Agribusiness Industry

Agribusiness plays an important role in the Indianapolis economy by connecting the city to Indiana’s broader agricultural strength. Indiana consistently ranks among the top U.S. states for corn and soybean production, and this large-scale output supports a wide range of agribusiness supply chains, processing activities, and support services tied to the Indianapolis metro area. While traditional farming is limited within Indianapolis itself, the city functions as a hub for agribusiness management, logistics, and technology firms that serve growers across the state. Indianapolis is also home to agriculture-related technology and agriscience companies, including Corteva Agriscience, reflecting the region’s shift toward data-driven farming, crop science, and agribusiness innovation rather than direct production.

Warehousing

Warehousing is a major driver of economic activity in Indianapolis, supported by one of the largest concentrations of industrial and distribution space in the Midwest. The city’s central U.S. location, access to major interstates (I-65, I-70, I-69, and I-465), rail networks, and proximity to Indianapolis International Airport make it an ideal hub for warehousing and distribution operations serving regional and national markets. In addition, Indianapolis offers a relatively affordable cost structure and a steady labor pool for logistics and fulfillment roles, which continues to attract warehouse operators, third-party logistics providers, and e-commerce distribution centers seeking efficiency and scalability.

Agribusiness & Warehousing Opportunities in Indianapolis: Startup Locations, Costs, and Business Plan Priorities

| Industry | Best Area of Town for a Small Business Startup | Estimated Startup Costs | Business Plan Focus (Why It Matters) |

|---|---|---|---|

| Agribusiness (Support, Tech, Services) | Downtown Indy, Fishers, Carmel, or Northside office corridors near I-465 for access to clients statewide | $75,000–$250,000 (office lease, software, staffing, sales & marketing) | Target Market Section is critical. Agribusiness in Indy is not about farming—it’s about who you serve (row-crop farmers, cooperatives, processors, ag-tech users). A strong target market section must clearly define customer segments by crop type, farm size, geography, and purchasing behavior. Lenders and investors want to see you understand how Indiana’s corn and soybean producers actually buy services and technology, not vague “agriculture customers.” |

| Warehousing / Distribution | West Side near the Airport, Park Fletcher, Plainfield, or Southside along I-70 / I-65 | $250,000–$1.5M+ (facility lease, racking, forklifts, insurance, labor, WMS systems) | Location is everything. The business plan must justify site selection based on interstate access, labor availability, and proximity to Indianapolis International Airport. In Indianapolis, minutes matter—being close to I-70, I-65, and air cargo routes directly affects delivery times, operating costs, and scalability. Poor location choice kills margins fast. |

How Dr. Paul Can Help...

Dr. Paul business plan writer services in Indianapolis establish measurable objectives and reveal what a business is truly capable of, whether operating near Downtown Indianapolis, along the I-465 corridor, or in surrounding Marion County markets. His financial projections create credibility with lenders, banks, and partners who expect clarity before funding decisions are made. Expert startup guidance trusted by founders across Indianapolis delivers the structure and confidence serious entrepreneurs need to move forward.

Ready To Get Started?

FAQ

Is the coffee shop market competitive locally?

Yes, competition is strong in Indianapolis, especially near Downtown, Mass Ave, and office-heavy districts. Clear differentiation and pricing strategy matter in these high-traffic areas.

Are flower shops viable in Indianapolis?

Flower shops succeed in Indianapolis when pricing reflects local demand across residential neighborhoods and commercial districts. Planning helps manage seasonality tied to weddings, events, and holidays.

Do flower shops face cost pressure locally?

Yes, Indianapolis flower shops face cost pressure from utilities, rent, and materials, particularly in high-visibility retail corridors. A business plan helps control expenses and protect margins.

Is the bail bondsman industry stable in Indianapolis?

Yes, demand remains steady in Indianapolis due to consistent activity within Marion County’s legal system. Proper planning supports compliance and long-term stability.

Do bail bondsman businesses need financial projections?

Yes, lenders in Indianapolis expect documented financial projections before approving funding. Clear numbers improve approval odds with local banks and underwriters.

Do banks in Indianapolis require formal plans?

Most lenders in Indianapolis require structured business plans before funding discussions move forward. Experience improving client success with banks and underwriters becomes critical in these reviews.

About the Author: Dr. Paul Borosky, DBA, MBA

Dr. Paul Borosky, MBA and DBA, CEO Partner and business plan writer, is dedicated to making CEOs stronger, sharper, and more effective, is the founder of Quality Business Plan, creator of Dr. Paul's Organize-Plan-Grow Strategy, author of numerous published books on Amazon, and publisher of over 1,000 business focused videos on YouTube. For over 14 years, he has helped entrepreneurs and small business owners turn business concepts into tangible businesses.