🚀 Decode Amazon.com's 2023 Financial Secrets Like a Pro! 📊

Amazon.com 2023 Beginner’s Guide Introduction:

Greetings, future finance maestros! Keen to unearth the financial narratives behind Amazon.com in 2023? Dive into "Amazon.com 2023: Beginner's Guide to Financial Analysis," presented by Quality Business Consultant and authored by the financial whiz Paul Borosky, MBA. This guide isn't just another finance book; it's your portal to understanding the financial gears of one of the tech and retail world's behemoths!

Why You'll Love This Guide:

- Crafted by a Finance Guru: 🎓 Navigate the financial terrain of Amazon.com with insights from Paul Borosky, MBA, delivered by Quality Business Consultant.

- Inside Look at Amazon's Finances: 📉 Explore Amazon.com's income statements and balance sheets for 2023, offering a lens into its financial pulse.

- Robust Ratio Analysis: 🧮 Dive into over twenty key financial ratios, unveiling what they signal about Amazon's financial health.

- Complexity Simplified: 📚 "In other words" segments translate dense financial lingo into digestible, engaging insights.

- Expert Analysis Tips: 💡 Arm yourself with Paul's analytical strategies to enhance your financial literacy, applicable in both academic and professional spheres.

- Advanced Insights Available: 🔍 Opt for our "Financial Analysis & Report" for an intricate look at Amazon, marrying AI-driven analysis with Paul Borosky's meticulous review.

Guide Highlights:

- Essential yet engaging Legal Disclaimer

- A captivating Forward to jumpstart your financial journey

- Detailed explorations of Income Statements and Balance Sheets for 2023

- Comprehensive walkthrough of Financial Ratios, empowering you with analytical skills

- A treasure trove of financial knowledge awaits!

Table of Contents Sneak Peek:

- Income Statement Exploration: Delving into revenues, expenses, and the intricate details

- Balance Sheet Analysis: Understanding assets, liabilities, and equity – the core financial pillars

- Financial Ratios Demystified: Equip yourself to analyze Amazon's financial vitality

Who's This For?

Designed for the ambitious business student and the budding entrepreneur, this guide is your steadfast companion in conquering the realm of financial analysis effortlessly.

Grab Your Copy:

Elevate your finance game with "Amazon.com 2023: Beginner's Guide to Financial Analysis." Transform intricate financial statements into actionable insights.

Additional Note: This beginner's guide aims to provide a foundational understanding of vital finance concepts, including the intricacies of income statements, balance sheets, and crucial financial ratios for their analysis. It includes a summarized overview of Amazon.com's financials, equipping you with company-specific data, calculations, and ratios. While the guide sets the stage for your financial analysis journey, delving into the analysis is your adventure. For those seeking an in-depth, company-specific examination, our "Financial Analysis & Report" offers detailed insights, combining AI precision with Paul Borosky, MBA's expert oversight.

Sincerely,

Paul, MBA

PDF/Downloadable Version

Click Below for the CURRENT

Downloadable PDF Price!!

Click Below for the CURRENT

Downloadable PDF Price!!

Sample Financial Report

Amazon.com: Concise Overview

Headquartered in Seattle, Washington, Amazon.com operates in the consumer cyclical sector, specifically within the internet retail segment. With an extensive workforce of approximately 1.2 million employees, the company serves consumers and commercial businesses across North America and internationally. Amazon.com comprises three primary business segments: North America, International, and Amazon Web Services (AWS). The company retails products and subscriptions, resells external products, and offers its lines of devices such as Kindle, Fire tablets, Fire TVs, Rings, Echo, and more.

From a financial analysis perspective, as of January 26th, 2022, Amazon.com stock is trading at $2799.72. The organization’s market capitalization is $1.4 trillion, and its beta value is currently 1.1, indicating a slightly higher risk than the overall market. The stock’s range falls between $2,707 and $3,773. It is noteworthy that, according to our research, Amazon.com has not yet issued dividends to its shareholders, suggesting the company is still in a growth phase.

Amazon.com Financial Report Sources

The report titled “Amazon.com 2021 Financial Statements and Financial Ratios: Defined, Discussed, and Analyzed for 5 Years” was authored by Paul Borosky, MBA, and owner of Quality Business Plan. To gather information for this summarized report, the author extensively researched Amazon.com’s 10k reports from various years, including Amazon.com’s 10k annual reports for 2019, 2016, 2020, and 2014. These reports served as the primary sources for data collection and analysis.

Upon collecting Amazon.com’s 10k annual statements, the author utilized a customized financial template to organize and present the company’s income statement and balance sheet information. The financial template allowed for a structured analysis of Amazon.com’s financial statements, facilitating the identification of key financial ratios and trends.

By combining comprehensive research, relevant 10k reports, and a customized financial template, the report provides readers with a detailed examination and analysis of Amazon.com’s financial statements and financial ratios over five years. This comprehensive approach ensures a thorough understanding of Amazon.com’s financial performance and positions the report as a valuable resource for investors, analysts, and individuals seeking insights into the company’s financial health.

Section 1: Amazon.com Income Statement Analyzed

This section comprehensively explains the income statement, highlighting its significance in financial analysis. The author defines and elaborates on specific line items within the income statement, including revenues, gross profits, and more, delving into the details of each item. After thoroughly discussing and defining each line item, the author offers a summary analysis of the crucial income statement line item trends specific to Amazon.com in most instances.

By presenting a broad definition of the income statement and its importance, readers gain a fundamental understanding of this financial statement’s role. The subsequent focus on individual line items allows a deeper comprehension of the components contributing to Amazon.com’s financial performance. Through the summary analysis, readers are provided with an overview of the trends within the income statement, enabling them to grasp key patterns and changes over time.

Overall, this section provides readers with a comprehensive breakdown of the income statement, its line items, and a concise analysis of Amazon.com’s income statement trends. This detailed approach equips individuals with the knowledge and insights to assess Amazon.com’s financial performance.

Importance of Understanding Amazon.com’s Income Statement for Financial Analysis

Understanding Amazon.com’s income statement is crucial for conducting a comprehensive financial analysis. The income statement summarizes the company’s revenues, expenses, and net income over a specific period. By analyzing Amazon.com’s income statement, analysts can assess its profitability, revenue growth, and cost management. Key components such as gross profit margins, operating expenses, and net income reveal insights into the company’s operational efficiency and financial performance. Understanding the income statement enables analysts to evaluate Amazon.com’s ability to generate profits, identify trends, and compare its performance to industry benchmarks. This understanding is essential for making informed decisions, assessing investment potential, and evaluating the company’s financial viability.

Revenue Growth:

In the last five years, Amazon’s revenues have grown, on average, about 27.7% annually. Its most significant growth year was 2020, which had a growth rate of 37.6%. Unfortunately, the organization’s growth declined to 21.7% last year. Granted, a 21% growth rate is pretty astounding, but it is not as good as in the previous year or 2018. Overall, an exceptional job was done.

Analyst Grade: A+

Amazon.com 2023 Income Statement Summary |

|||||

| Column1 | 2023 | 2022 | 2021 | 2020 | 2019 |

| Revenues | 574,785 | 513,983 | 469,822 | 386,064 | 280,522 |

| COGS | 304,739 | 288,831 | 272,344 | 233,307 | 165,536 |

| Gross Profit | 270,046 | 225,152 | 197,478 | 152,757 | 114,986 |

| SG&A | 11,816 | 11,891 | 8,823 | 6,668 | 5,203 |

| Depreciation | 48,663 | 41,921 | 34,433 | 25,180 | 21,789 |

| R & D | 85,622 | 73,213 | 56,052 | 42,740 | 35,931 |

| Other | - | - | - | - | - |

| Total Operating Expenses | 537,933 | 501,735 | 444,943 | 363,165 | 265,981 |

| EBIT | 36,852 | 12,248 | 24,879 | 22,899 | 14,541 |

| Other Income | - | - | - | ||

| Interest Expense | 3,182 | 2,367 | 1,809 | 1,647 | 1,600 |

| EBT | 37,557 | (5,936) | 38,151 | 24,178 | 13,976 |

| Taxes | 7,120 | 3,217 | 4,791 | 2,863 | 2,374 |

| Net Income | 30,425 | (2,722) | 33,364 | 21,331 | 11,588 |

Section 2: Amazon.com Balance Sheet Analyzed

In the section dedicated to Amazon.com’s balance sheet, a thorough examination of each significant line item is conducted. The author takes the time to define and elaborate on essential line items found within Amazon.com’s balance sheet, such as cash, property, plant and equipment, and liabilities. Through these definitions, readers gain a clear understanding of the specific components that make up Amazon.com’s balance sheet.

Following the definition and discussion of each line item, the author analyzes the crucial line items within Amazon.com’s balance sheet. This analysis offers valuable insights into the company’s financial position and strength. By examining these essential line items, readers can evaluate the company’s liquidity, asset composition, and overall financial stability.

By addressing each line item individually and providing analysis, readers can comprehend the intricate details of Amazon.com’s balance sheet. This approach enhances the reader’s ability to assess the company’s financial health and position. The analysis serves as a valuable tool for understanding the significance of each line item and its impact on Amazon.com’s overall financial standing.

Importance of Understanding Amazon.com Balance Sheet for Financial Analysis

Understanding Amazon.com’s balance sheet is paramount for conducting a thorough financial analysis. The balance sheet provides a snapshot of the company’s financial position at a specific time, showcasing its assets, liabilities, and shareholders’ equity. By examining Amazon.com’s balance sheet, analysts can assess its liquidity, solvency, and overall financial health. Key elements such as cash reserves, debt levels, and retained earnings offer insights into the company’s ability to meet short-term obligations, manage long-term debt, and fund future growth. Understanding the balance sheet enables analysts to make informed decisions, identify potential risks, and evaluate Amazon.com’s financial stability and performance within the broader market.

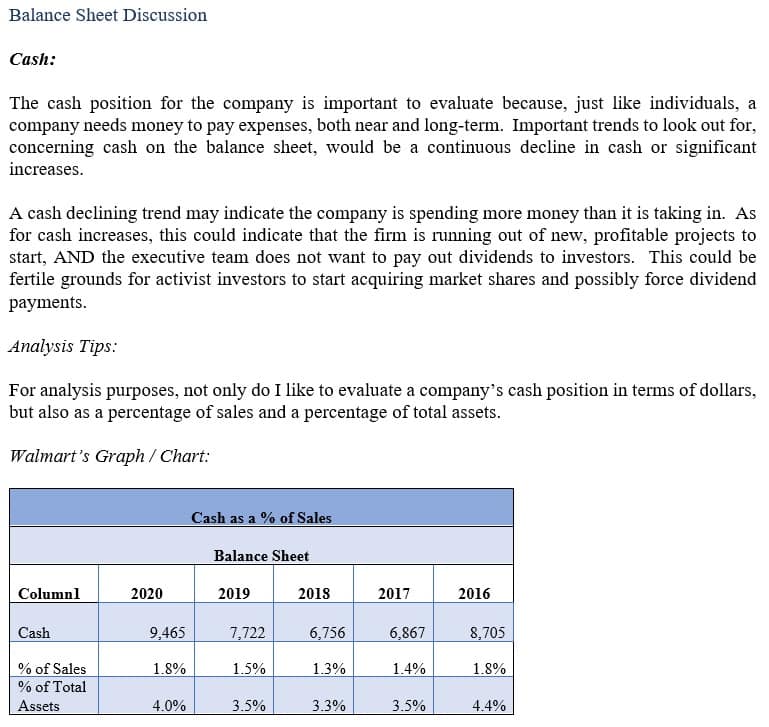

Amazon.com Cash:

Amazon’s cash holdings have continually increased from $20.5 billion in 2017 to $42.1 billion in 2020. Fortunately, the organization’s cash holdings will decrease slightly to $36.2 billion in 2021. This decrease may indicate that the organization is shifting its cash to other, more profitable areas of its business, such as short-term investments. If it holds, it is an excellent trend, and my assumption is correct.

Analyst Grade: A

Amazon.com 2023 Summary Balance Sheet |

|||||

| Column1 | 2023 | 2022 | 2021 | 2020 | 2019 |

| Cash | 73,387 | 53,888 | 36,220 | 42,122 | 36,092 |

| Short Term Investment | 13,393 | 16,138 | 59,829 | 42,274 | 18,929 |

| Account Receivable | 52,253 | 42,360 | 32,891 | 24,542 | 20,816 |

| Inventory | 33,318 | 34,405 | 32,640 | 23,795 | 20,497 |

| Other | - | - | - | ||

| Current Assets | 172,351 | 146,791 | 161,580 | 132,733 | 96,334 |

| Net PPE | 204,177 | 186,715 | 160,281 | 113,114 | 72,705 |

| Goodwill | 22,789 | 20,288 | 15,371 | 15,017 | 14,754 |

| Other | - | - | - | ||

| Total Assets | 527,854 | 462,675 | 420,549 | 321,195 | 225,248 |

| Accounts Payable | 84,981 | 79,600 | 78,664 | 72,539 | 47,183 |

| Accrued Expense | 64,709 | 62,566 | 51,775 | 44,138 | 32,439 |

| Accrued Taxes | - | - | - | - | - |

| Notes Payable | - | - | - | - | - |

| LT Debt - Current | - | - | - | - | - |

| Other | - | - | - | - | |

| Total Current Liabilities | 164,917 | 155,393 | 142,266 | 126,385 | 87,812 |

| LT Debt | 58,314 | 67,150 | 48,744 | 31,816 | 23,414 |

| Other | - | - | - | ||

| Total Liabilities | 325,979 | 316,632 | 282,304 | 227,791 | 163,188 |

| Common Stock | 99,134 | 75,174 | 55,543 | 42,870 | 33,663 |

| Treasury | 7,837 | 7,837 | 1,837 | 1,837 | 1,837 |

| Retained Earnings | 113,618 | 83,193 | 85,915 | 52,551 | 31,220 |

| Other | - | - | - | - | |

| Total Equity | 201,875 | 146,043 | 138,245 | 93,404 | 62,060 |

| Total Equity & Liability | 527,854 | 462,675 | 420,549 | 321,195 | 225,248 |

Section 3: Amazon.com Financial Ratios Analyzed

In the concluding section, the author selects approximately 12 different financial ratios and proceeds to review and discuss some essential financial ratios specific to Amazon.com. The author begins by providing explicit definitions for each financial ratio, ensuring readers understand its purpose and relevance in financial analysis. Next, the author supplies the financial formulas for calculating each specific ratio, equipping readers with the tools to perform their ratio analysis.

After presenting the definitions and formulas, a concise analysis of the critical financial ratios is provided. This analysis offers valuable insights into Amazon.com’s financial performance and position of Amazon.com, allowing readers to evaluate the company’s profitability, liquidity, solvency, and other critical aspects of its financial health. By assessing these essential financial ratios, readers gain a comprehensive overview of Amazon.com’s financial strength and efficiency.

This section offers readers a well-rounded understanding of the significance and implications of financial ratios on Amazon.com by addressing a range of financial ratios, providing formulas, and offering brief analyses. The information presented enables readers to interpret and evaluate the company’s financial performance more confidently and precisely.

Amazon.com’s Current Ratio:

Amazon’s current ratio in 2021 was 1.14, slightly above 1.0, the gold standard in finance. This indicates that the organization is slightly mismanaging its short-term assets. A better scenario would be to reduce its current ratio to about 1.0, if not slightly under.

Analyst Grade: B

Importance of Understanding Amazon.com’s current ratio

Understanding Amazon.com’s current ratio is paramount when conducting a company’s financial analysis. The current ratio is a crucial liquidity ratio that measures a company’s ability to meet its short-term obligations with its current assets. For Amazon.com, a high current ratio indicates a strong ability to cover short-term liabilities, signifying financial stability and solvency. Conversely, a low current ratio may indicate potential liquidity challenges. By examining Amazon.com’s current ratio, analysts can assess its liquidity position, evaluate its short-term financial health, and make informed decisions regarding investment strategies or financial planning.

Amazon.com’s Total Asset Turnover:

In the last four years, Amazon’s total asset turnover has continually fallen from 1.4 in 2018 to 1.12 in 2021. This means the firm generates fewer revenues using the organization’s total assets. To mitigate this problem, the company could start paying dividends to its shareholders.

Analyst Grade: C+

Importance of Understanding Amazon.com’s Totat Asset Turnover in Financial Analysis

Understanding Amazon.com’s total asset turnover is crucial when conducting a financial analysis for the company. The total asset turnover ratio measures how efficiently a company utilizes its assets to generate sales. For Amazon.com, a high total asset turnover ratio indicates effective asset management and the ability to generate substantial revenue from its asset base. This ratio provides insights into the company’s operational efficiency, resource allocation, and productivity. Analysts can use the total asset turnover ratio to assess Amazon.com’s ability to generate sales relative to its asset investment and compare it to industry benchmarks. A higher ratio suggests better utilization of assets, while a lower ratio may indicate room for improvement in optimizing asset performance.