Hey All,

Thanks for visiting my Target Corp. Financial Report page. On this page, you will be able to find preliminary information about Target's current financial performance as well as some historical track records and trends.

For a more detailed examination of Target's financial performance, please check out the "Financial Report". In this report, written by myself, Paul Borosky, MBA., Doctoral Candidate, and published author, you will find:

- Summarized income statement for the last 5 years.

- Summarized balance sheet for the last 5 years.

- Summary analysis by myself of the important income statement, balance sheet, and financial ratio trends and other happenings.

- Five years’ worth of over twenty common financial ratios presented with formulas, calculations, and analysis tips for each ratio.

- Line by line description, explanation, and analysis tip for most financial statement line items and financial ratios.

- Professional financial analysis tips are provided in each section to help YOU conduct your OWN financial analysis!

- Each section includes an “in other words” segment. This is where I use plain English to explain concepts.

Enjoy the preliminary information and for a more detailed analysis, buy the financial report!

Sincerely,

Paul, MBA.

PDF/Downloadable Version

- Free Bonus Downloads: Target's Annual Statements for the Last Five Years (10k reports)!

Sample Financial Report

Target Corp. Brief Summary

Target's global headquarters is located in Minneapolis, Minnesota. The organization competes in the discount store industry. Specifically, the consumer defense sector of the industry. At present, the company employs approximately 368,000 individuals. The main products offered by the organization would include grocery goods, home decor products, electronics, and seasonal offerings.

From a financial perspective, the organization currently has a market cap of approximately $54.6 billion. Their beta is .65. This indicates that the organization is less risky an investment as compared to the overall market. In the last 52 weeks, their stock prices range from $70.03 to $130.24. The last dividend paid was in February 2020 at $0.66 a share.

Target Financial Report Sources

“Target Corp. 2019 Financial Report: Financial Statements and Financial Ratios: Defined, Discussed, and Analyzed for 5 Years” was written by, Paul Borosky, MBA. and owner of Quality Business Plan. In this report, I used Target's 2019 10k, Target's 2017 10k annual report, Target's 2016 10k annual report, Target's 2015 10k annual report as the basis for information gathering.

Section 1: Target Corp. Income Statement Analyzed 2015 to 2019

In this section, I walk through a broad definition as to what an income statement is and why it is important. From this, I then discuss and define income statement line items, such as revenues, gross profits, etc. in detail. After each line item is defined and discussed, I finally offer a summary analysis of Target's important income statement line item trends from 2015 to 2019, in most cases.

Revenue Growth: Target achieved sales in 2015 of approximately $73.7 billion. In the next two years, Target sales would decrease to 69.5 billion in 2016 and 71.8 billion in 2017. However, in the last two years, their sales have rebounded to $75.4 billion in 2018 and then 78.1 billion in 2019. A driving factor for their revenue growth may be their ability to increase online retail sales. On a final note, the company’s annual growth rate for the last five years was 1.5%.

Cost of Goods Sold: In 2015, the company achieved a 70.8% cost of goods as compared to revenues. In the next two years, the cost of goods as compared to revenues would increase to 71.2%. This indicates that the company is either doing a poor job negotiating prices for their products. Or, the company is unable to pass on increased product costs to its customers due to elevated competition. However, in the last two years, the company has been able to reduce its cost of goods as compared to revenues. This resulted in a 70.2% cost of goods as compared to revenues in 2019. In such a highly competitive industry, with competitors such as Walmart and Amazon, being able to lower their cost of goods as compared to revenues is an admirable achievement.

Target Corp. 2019 Summary Income Statement |

|||||

| Column1 | 2019 | 2018 | 2017 | 2016 | 2015 |

| Revenues | 78,112 | 75,356 | 71,786 | 69,495 | 73,785 |

| COGS | 54,864 | 53,299 | 51,125 | 49,415 | 52,241 |

| Gross Profit | 23,248 | 22,057 | 20,661 | 20,080 | 21,544 |

| SG&A | 16,233 | 15,723 | 15,140 | 13,356 | 14,665 |

| Depreciation | 2,357 | 2,224 | 2,225 | 2,025 | 1,969 |

| R & D | |||||

| Other | |||||

| Operating Expenses | 18,590 | 17,947 | 17,365 | 15,381 | 16,634 |

| EBIT | 4,658 | 4,110 | 4,224 | 4,969 | 5,530 |

| Other Income | - | - | - | - | - |

| Interest Expense | 477 | 461 | 653 | 1,004 | 607 |

| EBT | 4,181 | 3,649 | 3,571 | 3,965 | 4,923 |

| Taxes | 921 | 746 | 722 | 1,296 | 1,602 |

| Net Income | 3,281 | 2,937 | 2,914 | 2,737 | 3,363 |

Section 2: Target Corp. Balance Sheet Analyzed from 2015 to 2019

For Target Corp. balance sheet, I again go through each important line item from the balance sheet. In reviewing each line item, I will define the Target's balance sheet line item, such as cash, property, plant and equipment, and liabilities between 2015 to 2019. Next, I then offer a summary analysis of Target's important balance sheet line items.

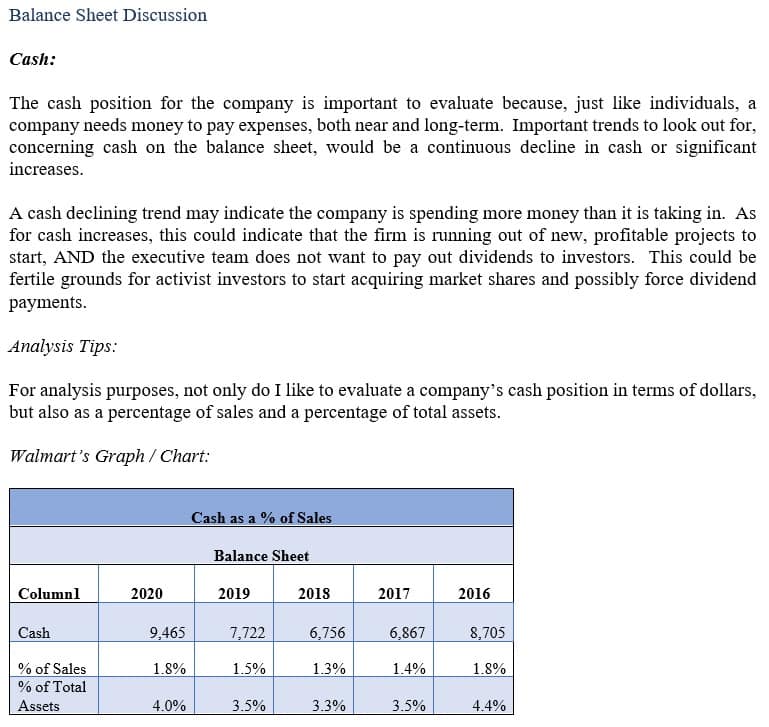

Cash: Target ended 2015 with about $4 billion in cash. In the next three years, the company would reduce its cash position to approximately $1.6 billion. For 2019, the cash position would rebound to about $2.7 billion. The fluctuation in Target’s cash position, ranging from $4 billion to $1.5 billion, indicates that the company has yet to identify an optimal cash position to ensure liquidity in the short term, while fully optimizing this asset.

Short-term Investments: In the last five years, Target has not used short-term investments. Without the use of short-term investments, the company may be holding excess cash. By holding excess cash, the company is not earning interest on the asset. In other words, their elevated cash position may be underutilizing their assets. A better strategy would be for the company to identify a specific cash balance needed to ensure liquidity for the short term. Any additional funds should be thrown into short-term investments.

Target Corp. 2019 Summary Balance Sheet |

|||||

| Column1 | 2019 | 2018 | 2017 | 2016 | 2015 |

| Cash | 2,577 | 1,556 | 2,643 | 2,512 | 4,046 |

| Short Term Investment | - | - | - | - | - |

| Account Receivable | - | - | - | - | - |

| Inventory | 8,992 | 9,497 | 8,657 | 8,309 | 8,601 |

| Other | - | - | - | - | - |

| Current Assets | 12,902 | 12,519 | 12,564 | 11,990 | 14,130 |

| Net PPE | 26,283 | 25,533 | 25,018 | 24,658 | 25,217 |

| Goodwill | - | - | - | - | - |

| Other | - | - | - | - | - |

| Total Assets | 42,779 | 41,290 | 38,999 | 37,431 | 40,262 |

| Accounts Payable | 9,920 | 9,761 | 8,677 | 7,252 | 7,418 |

| Accrued Expense | 4,406 | 4,201 | 4,254 | 3,737 | 4,236 |

| Accrued Taxes | 1,122 | 972 | 713 | 861 | 823 |

| Notes Payable | - | - | - | - | - |

| LT Debt - Current | 161 | 1,052 | 270 | 1,718 | 815 |

| Other | - | - | - | - | - |

| Total Current Liabilities | 14,487 | 15,014 | 13,201 | 12,707 | 12,622 |

| LT Debt | 11,338 | 10,223 | 11,317 | 11,031 | 11,945 |

| Other | - | - | - | - | - |

| Total Liabilities | 30,946 | 29,993 | 27,290 | 26,478 | 27,305 |

| Common Stock | 6,268 | 6,085 | 5,903 | 5,707 | 5,398 |

| Treasury | - | - | - | - | - |

| Retained Earnings | 6,433 | 6,017 | 6,553 | 5,884 | 8,188 |

| Other | - | - | - | - | - |

| Total Equity | 11,833 | 11,297 | 11,709 | 10,953 | 12,957 |

| Total Equity & Liability | 42,779 | 41,290 | 38,999 | 37,431 | 40,262 |

Section 3: Target Corp. Financial Ratios Analyzed from 2015 to 2019

For this section, I have chosen several different financial ratios to review for Target Corp. from 2015 to 2019. In reviewing each of Target's financial ratios, I first start with defining the financial ratio. Next, I supply the financial formula for calculating the specific ratio. Finally, I offer a brief analysis of Target's Important Financial ratios.

Current Ratio: Target’s current ratio ended 2015 at 1.12. This indicated that the organization had more than enough current assets to cover its current liabilities for the next 12 months. Over the next four years, the company would reduce its current ratio to approximately .89. Because the company has significant cash flow on a daily basis, investors should expect the organization to continually reduce their current ratio position to approximately .7 to .6. This would be more in line with industry competitors.

Total Asset Turnover: Target Corporation’s total asset turnover ranged between 1.83 in 2015 to 1.86 in 2016, ending 2019 at 1.83. Such a tight range for total asset turnover indicates that the firm’s executive team is satisfied with the amount of assets used to generate their revenues. In the retail industry, with high competition and low profit margins, identifying a workable total asset turnover strategy may be an excellent foundation to build sustainable competitive advantages.

Return on Equity: In 2015, the company’s return on assets was 25.9%. In the next two years, the return on equity would fall to 24.9%. Fortunately, in 2018 and 2019, the return on equity would rebound, ending 2019 at 27.7%. If the organization takes on more debt, then the firm can use the debt for operations or expansion. In doing this, the company may enjoy the opportunity of earning money with borrowed money. This inevitably leads to a steadily increasing return on equity ratios.

Target Corp 2019 Liquidity Ratios |

|||||

| Ratios | 2019 | 2018 | 2017 | 2016 | 2015 |

| Current Ratio | 0.89 | 0.83 | |||

| Cash Ratio | 0.18 | 0.10 | |||

| Quick Ratio | 0.27 | 0.20 | |||

| Net Working Capital | (3,879) | (3,881) | |||

Target Corp 2019 Asset Utilization |

|||||

| Ratios | 2019 | 2018 | 2017 | 2016 | 2015 |

| Total Asset Turnover | 1.83 | 1.83 | |||

| Fixed Asset Turnover | 2.97 | 2.95 | |||

| Days Sales Outstanding | - | - | |||

| Inventory Turnover | 8.69 | 7.93 | |||

| Accounts Receivable Turnover | |||||

| Working Capital Turnover | (20.14) | (19.42) | |||

| AP Turnover | 7.87 | 7.72 | |||

| Average Days Inventory | 0.02 | 0.02 | |||

| Average Days Payable | 0.02 | 0.02 | |||

Target Corp 2019 Profitability Ratios |

|||||

| Ratios | 2019 | 2018 | 2017 | 2016 | 2015 |

| Return on Assets | 7.67% | 7.11% | |||

| Return on Equity | 27.73% | 26.00% | |||

| Net Profit Margin | 4.20% | 3.90% | |||

| Gross Profit Margin | 29.76% | 29.27% | |||

| Operating Profit Margin | 5.96% | 5.45% | |||

| Basic Earning Power | 10.89% | 9.95% | |||

| ROCE | 16.46% | 15.64% | |||

| Capital Employed | 28,292 | 26,276 | |||

| ROIC | 16.21% | 15.10% | |||

Target Corp 2019 Long-term Debt |

|||||

| Ratios | 2019 | 2018 | 2017 | 2016 | 2015 |

| Debt Ratio | 26.50% | 24.76% | |||

| Debt/Equity | 95.82% | 90.49% | |||

| Times Interest Earned | 9.77 | 8.92 | |||