🚀 Coca-Cola's 2023 Financial Dynamics Like a Pro! 📊

Coca-Cola 2023 Beginner’s Guide Introduction:

Greetings, aspiring finance enthusiasts! Are you keen to understand the financial workings of Coca-Cola in 2023? We proudly present "Coca-Cola 2023: Beginner's Guide to Financial Analysis," your essential toolkit provided by Quality Business Consultant and authored by the finance expert, Paul Borosky, MBA. This guide is designed to be your engaging entrance into the financial world of one of the globe's most iconic beverage companies.

Why You'll Love This Guide:

- Guidance from a Finance Expert: 🎓 With Paul Borosky, MBA, navigate through Coca-Cola's financial landscape in 2023, courtesy of Quality Business Consultant.

- Coca-Cola's Financial Overview: 📉 Gain an intimate understanding of Coca-Cola's income statements and balance sheets for 2023, revealing the company's financial status.

- Detailed Ratio Analysis: 🧮 Explore over twenty critical financial ratios to shed light on Coca-Cola's financial health.

- Clear and Accessible Insights: 📚 "In other words" sections translate financial terminology into clear, conversational language.

- Expert Analysis Tips: 💡 Apply Paul's top-tier analysis tips to refine your financial analytical skills, whether in the classroom or the boardroom.

- Enhanced Content Option: 🔍 Delve deeper with our "Financial Analysis & Report," offering an in-depth examination of Coca-Cola, integrating AI insights with Paul Borosky's experienced review.

Guide Highlights:

- Engaging Legal Disclaimer

- Insightful Forward to spark your financial curiosity

- Comprehensive breakdowns of Coca-Cola's Income Statements and Balance Sheets for 2023

- Financial Ratios: Your key to unlocking analytical acumen

- A treasure trove of financial knowledge awaits you!

Table of Contents Sneak Peek:

- Delving into Income Statements: Understanding Revenue, Expenses, and more

- Balance Sheet Explorations: Analyzing Assets, Liabilities, and Equity in detail

- Financial Ratios Decoded: Learn to interpret key financial indicators

Who's This For?

Ideal for business students and emerging entrepreneurs, this guide is your dependable resource for mastering the art of financial analysis, tailored to the context of Coca-Cola.

Get Your Copy Now:

Embrace the role of a financial analyst with "Coca-Cola 2023: Beginner's Guide to Financial Analysis." Turn intricate financial data into actionable insights.

Additional Note:

This beginner's guide is crafted to provide you with a foundational understanding of vital finance concepts, focusing on income statements, balance sheets, and the essential financial ratios for their analysis. It includes a summarized presentation of Coca-Cola's financials, offering you the calculations and ratios specific to the company. While the guide equips you with the tools for individual analysis, the comprehensive financial dissection is in your hands. For an in-depth, company-specific exploration, our "Financial Analysis & Report" delivers meticulous insights, merging AI technology with Paul Borosky, MBA's expert analysis.

Sincerely,

Paul, MBA.

PDF/Downloadable Version

Click Below for the CURRENT

Downloadable PDF Price!!

Click Below for the CURRENT

Downloadable PDF Price!!

Sample Financial Report

Coca-Cola’s Company Summary

The Coca-Cola Company is a prestigious global beverage corporation headquartered in Atlanta, Georgia. Established in 1886, it is one of the most iconic and valuable brands worldwide. The company offers an extensive array of non-alcoholic drinks, including soft drinks, juices, energy drinks, and bottled water, serving a broad international customer base.

Coca-Cola, the company’s signature drink, has gained remarkable fame and is often equated with the brand itself. The company has a presence in over 200 countries, backed by a robust distribution network that ensures the global availability of its products. Its brand portfolio includes well-known names like Sprite, Fanta, Dasani, Minute Maid, and Powerade, appealing to diverse consumer tastes.

The success of The Coca-Cola Company can be credited to its dynamic marketing strategies, comprehensive product lineup, and commitment to innovation. The company highly emphasizes sustainability and environmental stewardship, aiming to reduce its ecological impact while promoting water conservation and recycling efforts.

Financially, Coca-Cola has a market capitalization of approximately $264.66 billion and a beta of 0.55, suggesting lower risk than the broader market. Its stock price has fluctuated between $54.02 and $65.47 over the past 52 weeks. Over the last year, dividend payouts have increased slightly, with the current dividend yield at 2.97% (10/23).

Coca-Cola Financial Report Sources

“Coca-Cola 2021 Financial Statements and Financial Ratios: Defined, Discussed, and Analyzed for 5 Years with AI Insights” was written by Paul Borosky, MBA., doctoral candidate and owner of Quality Business Plan. In this summarized report, the author researched Coca-Cola’s (Coke) 10k, Coca-Cola’s 2020 10k annual report, Coca-Cola’s 2016 10k annual report, Coca-Cola’s 2019 10k annual report, and Coca-Cola’s 2019 10k annual report as the basis for information gathering. Once all of Coca-Cola’s 10k annual statements were collected, the author then inserted Coca-Cola’s income statement information and Coca-Cola’s balance sheet information into a customized financial template.

Section 1: Coca-Cola Income Statement

This section provides a comprehensive overview of the income statement, emphasizing its significance in financial analysis. It begins with a broad definition and explanation of the income statement, highlighting its importance in assessing a company’s financial performance. Subsequently, each line item, including revenues, gross profits, and more, is thoroughly defined and discussed in detail. By examining Coca-Cola’s income statement, I present a summary analysis of the company’s crucial income statement line item trends over the past five years, offering valuable insights into its financial performance using AI insights. This analysis enables readers to understand better Coca-Cola’s revenue generation, profitability, and key cost components, facilitating informed decision-making and comprehensive financial analysis.

Coca-Cola 2023 Income Statement Summary |

|||||

| Column1 | 2023 | 2022 | 2021 | 2020 | 2019 |

| Revenues | 45,754 | 43,004 | 38,655 | 33,014 | 37,266 |

| COGS | 18,520 | 18,000 | 15,357 | 13,433 | 14,619 |

| Gross Profit | 27,234 | 25,004 | 23,298 | 19,581 | 22,647 |

| SG&A | 13,972 | 12,880 | 12,144 | 9,731 | 12,103 |

| Depreciation | 1,128 | 1,260 | 1,452 | 1,536 | 1,365 |

| R & D | |||||

| Other | 1,951 | 1,215 | 846 | 853 | 458 |

| Total Operating Expenses | 17,051 | 15,355 | 14,442 | 12,120 | 13,926 |

| EBIT | 11,311 | 10,909 | 14,022 | 11,186 | 11,732 |

| Other Income | |||||

| Interest Expense | 1,527 | 882 | 1,597 | 1,437 | 946 |

| EBT | 12,952 | 11,686 | 12,425 | 9,749 | 10,786 |

| Taxes | 2,249 | 2,115 | 2,621 | 1,981 | 1,801 |

| Net Income | 10,703 | 9,571 | 9,804 | 7,768 | 8,985 |

Revenue Growth:

Coca-Cola’s revenues have consistently grown over the past five years, with 2022 revenues reaching $43,004 million, a significant increase from the previous year’s $38,655 million. This represents a revenue growth rate of 11.3% in 2022, following a substantial 17.1% growth in 2021. However, it’s worth noting that the company experienced a temporary setback in 2020, where revenues declined by 11.4%, possibly due to the economic impact of the COVID-19 pandemic.

The revenue growth rate in 2019 was 8.6%, demonstrating the company’s resilience in challenging market conditions. Two thousand eighteen specific growth data were unavailable (N/A), but the overall trend suggests that Coca-Cola has consistently increased its revenues. This positive revenue growth trajectory reflects the company’s strong market presence and effective business strategies in the beverage industry.

Importance of Coca-Cola Income Statement for Financial Analysis:

Section 2: Coca-Cola Balance Sheet Analyzed

A thorough analysis of the company’s balance sheet is conducted in the second section of the Coca-Cola financial report. Each significant line item from the balance sheet, such as cash, property, plant and equipment, and liabilities, is carefully reviewed and defined. The analysis spans five years, providing insights into the trends and changes in these balance sheet items over time. Analysts can assess the company’s financial stability, asset management, and debt obligations by examining Coke’s balance sheet. This analysis helps understand the company’s financial health, evaluate its ability to meet its short-term and long-term obligations and identify areas of strength or concern.

Coca-Cola 2023 Summary Balance Sheet |

|||||

| Column1 | 2023 | 2022 | 2021 | 2020 | 2019 |

| Cash | 9,366 | 9,519 | 9,684 | 6,795 | 6,480 |

| Short Term Investment | 4,297 | 2,112 | 2,941 | 4,119 | 4,695 |

| Account Receivable | 3,410 | 3,487 | 3,512 | 3,144 | 3,971 |

| Inventory | 4,424 | 4,233 | 3,414 | 3,266 | 3,379 |

| Other | |||||

| Current Assets | 26,732 | 22,591 | 22,545 | 19,240 | 20,411 |

| Net PPE | 9,236 | 9,841 | 9,920 | 10,777 | 10,838 |

| Goodwill | 18,358 | 18,782 | 19,363 | 17,506 | 16,764 |

| Other | |||||

| Total Assets | 97,703 | 92,763 | 94,354 | 87,296 | 86,381 |

| Accounts Payable | 15,485 | 15,749 | 14,619 | 11,145 | 11,312 |

| Accrued Expense | |||||

| Accrued Taxes | 1,569 | 1,203 | 686 | 788 | 414 |

| Notes Payable | 4,557 | 2,373 | 3,307 | 2,183 | 10,994 |

| LT Debt - Current | 1,960 | 399 | 1,338 | 485 | 4,253 |

| Other | |||||

| Total Current Liabilities | 23,571 | 19,724 | 19,950 | 14,601 | 26,973 |

| LT Debt | 35,547 | 36,377 | 38,116 | 40,125 | 27,516 |

| Other | |||||

| Total Liabilities | 70,223 | 66,937 | 69,494 | 66,012 | 44,185 |

| Common Stock | 20,969 | 20,582 | 19,876 | 19,361 | 18,914 |

| Treasury | 54,535 | 52,601 | 51,641 | 52,016 | 52,244 |

| Retained Earnings | 73,782 | 71,019 | 69,094 | 66,555 | 65,855 |

| Other | |||||

| Total Equity | 27,480 | 25,826 | 24,860 | 21,284 | 21,098 |

| Total Equity & Liability | 97,703 | 92,763 | 94,354 | 87,296 | 65,283 |

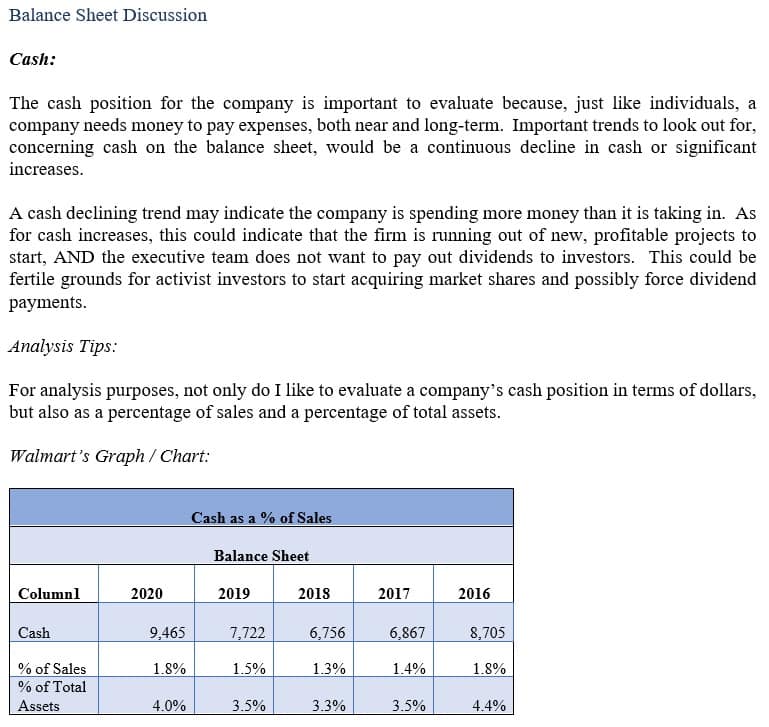

Sample- Cash: Coca-Cola’s cash position, as a percentage of sales, reflects its liquidity and ability to cover short-term financial obligations. In 2022, the company held $9,519 million in cash, representing 22.1% of its total sales of $43,004 million. This indicates that Coca-Cola had a substantial cash reserve relative to its sales revenue, suggesting a solid liquidity position.

Over the past five years, the percentage of cash relative to sales has fluctuated. In 2021, the percentage was 25.1%, which was higher than in 2020, when it was 20.6%. This increase may indicate a more conservative approach to maintaining cash reserves in uncertain economic conditions.

Furthermore, examining cash as a percentage of total assets, it’s evident that Coca-Cola has consistently held a double-digit percentage of its assets in cash, ranging from 7.5% to 10.9%. This signifies the company’s emphasis on maintaining a solid cash position to cover operational needs, potential investments, and contingencies.

A healthy cash position is essential for a company’s financial stability and flexibility, allowing it to seize opportunities and weather economic downturns effectively. Coca-Cola’s consistent focus on cash management is a positive aspect of its financial profile.

Importance of Coca-Cola’s Balance Sheet for Financial Analysis

The Coca-Cola balance sheet is essential in financial analysis as it provides a snapshot of the company’s financial position at a given time. This statement presents a detailed overview of Coca-Cola’s assets, liabilities, and shareholders’ equity, allowing analysts to assess its financial strength, liquidity, and solvency. By examining the balance sheet, financial professionals can evaluate Coca-Cola’s asset management and utilization, including the composition of its asset base, such as cash, inventory, and property. They can also analyze the company’s liabilities, including short-term and long-term debts, and assess its ability to meet financial obligations.

The balance sheet helps identify trends and changes in Coca-Cola’s financial position, highlighting growth areas or potential risks. It enables comparisons with industry peers and benchmarking against industry standards. Furthermore, the balance sheet is a foundation for calculating critical financial ratios, such as the debt-to-equity ratio, current ratio, and return on assets, providing insights into Coca-Cola’s financial performance and efficiency.

The Coca-Cola balance sheet is crucial for financial analysis as it offers valuable information for assessing the company’s financial health, making informed decisions, and evaluating its long-term sustainability and growth potential.

Section 3: Coca-Cola’s Financial Ratio Summary

A comprehensive analysis of critical financial ratios is conducted in the third section of the Coca-Cola financial report. Around 10 critical financial ratios for Coca-Cola have been reviewed over the last five years. Each ratio is defined, and its corresponding formula for calculation is provided. This analysis enables a deep understanding of Coca-Cola’s financial performance and efficiency. Important ratios, such as liquidity, profitability, and solvency, are analyzed to assess the company’s liquidity position, profitability, and ability to meet financial obligations. By examining these ratios over five years, analysts can identify trends, strengths, and areas of improvement within Coca-Cola’s financial performance, aiding in strategic decision-making and financial planning.

Coca-Cola Current Ratio

Current Ratio.

Coca-Cola’s current ratio, which measures its short-term liquidity and ability to meet its current obligations, has fluctuated over the past five years. In 2022, the current ratio was 1.15, indicating that the company had $1.15 in current assets for every $1 in current liabilities. This suggests that Coca-Cola had a reasonably healthy liquidity position, with sufficient short-term assets to cover its immediate financial obligations.

Comparing this to 2021, when the current ratio was 1.13, and 2020 when it was 1.32, it’s clear that there has been some variation in the company’s liquidity. The decrease in the current ratio in 2021 and 2022 may reflect changes in the composition of current assets or liabilities, emphasizing the importance of ongoing monitoring of liquidity metrics.

In contrast, in 2019, the current ratio was just 0.76, indicating a potentially strained liquidity position. The improvement in subsequent years suggests that Coca-Cola has taken steps to strengthen its short-term liquidity and financial stability.

A current ratio above 1 is generally considered healthy, as it signifies that a company has more current assets than current liabilities. Coca-Cola’s ability to maintain a current ratio above 1 in recent years is a positive sign of its liquidity management.

Importance of Coca-Cola’s Financial Ratios for Financial Analysis

Financial ratios are crucial tools for conducting a thorough financial analysis of Coca-Cola. These ratios offer valuable insights into the company’s financial performance, enabling analysts to evaluate its profitability, ability to meet short-term and long-term obligations, efficiency, and overall financial well-being.

When we examine Coca-Cola’s financial ratios, we can assess its profitability using metrics like return on assets (ROA) and equity (ROE). Liquidity ratios, such as current and quick ratios, help us understand how well Coca-Cola can cover its short-term bills and manage its cash flow.

Solvency ratios, including the debt-to-equity and interest coverage ratios, give us a sense of Coca-Cola’s long-term financial stability and capacity to handle debt obligations. Efficiency ratios, such as asset and inventory turnover, indicate how effectively the company uses and manages its assets.

By analyzing these financial ratios over time and comparing them to industry standards and competitors, we can spot trends, identify strengths and weaknesses, and pinpoint areas where Coca-Cola can improve its financial performance. This information is crucial for making well-informed decisions, crafting effective strategies, and evaluating Coca-Cola’s financial standing in the market. Financial ratios are invaluable for assessing Coca-Cola’s overall financial performance and sustainability.