🚀 Navigate Walmart's 2023 Financial Landscape with Expertise! 📊

Walmart 2023 Beginner’s Guide Introduction:

Hello, future finance professionals! Are you ready to delve into the financials of Walmart, one of the retail giants, for the year 2023? Introducing "Walmart 2023: Beginner's Guide to Financial Analysis," brought to you by Quality Business Consultant and crafted by the adept finance specialist, Paul Borosky, MBA. This isn't just a set of financial statements; it's a comprehensive guide to understanding the economic pulse of a retail powerhouse.

Why You'll Love This Guide:

- Expert-Led Financial Exploration: 🎓 Traverse the financial avenues of Walmart in 2023 under the guidance of finance expert Paul Borosky, MBA, presented by Quality Business Consultant.

- Summary Financial Statements: 📉 Gain an in-depth look at Walmart's income statements and balance sheets for 2023, so you can illuminate its financial performance and position.

- Extensive Ratio Analysis: 🧮 Decode and understand over twenty vital financial ratios to get a holistic view of Walmart's financial health.

- Financial Terminology Unpacked: 📚 "In other words" sections break down and clarify complex financial terms, making them easy to grasp and apply.

- Actionable Analysis Techniques: 💡 Leverage Paul's specialized tips to refine your financial analysis techniques, beneficial for both academic learning and professional application.

- Detailed Insights with the Full Report: 🔍 Dive deeper with our "Financial Analysis & Report," offering a granular look at Walmart's finances, blending Paul Borosky's expertise with AI-driven analytics.

Guide Highlights:

- An easy-to-understand Legal Disclaimer

- A Forward that sets the stage for your financial deep dive

- Rigorous analysis of Income Statements and Balance Sheets for 2023

- A detailed review of Financial Ratios to aid your analytical journey

- A wealth of financial insights ready for exploration!

Table of Contents Sneak Peek:

- Dissecting the Income Statement: Examining revenue, expenses, and net earnings

- The Balance Sheet Decoded: Analyzing assets, liabilities, and equity to understand financial stability

- Mastering Financial Ratios: Tools to evaluate Walmart's financial efficacy and strategy

Who's This For?

Ideal for business students keen on finance and entrepreneurs seeking to understand retail financials, this guide is a stepping stone to mastering financial analysis with a focus on Walmart.

Boost Your Financial Knowledge:

Elevate your understanding of financial analysis with "Walmart 2023: Beginner's Guide to Financial Analysis." Transform detailed financial reports into strategic business insights.

Additional Note: This beginner's guide provides a foundational understanding of essential financial concepts, focusing on income statements, balance sheets, and key financial ratios for their analysis. It presents a summarized version of Walmart's 2023 financials, offering targeted data, calculations, and ratios for your analytical endeavors. While the guide supplies the tools for financial exploration, the in-depth analysis is your challenge. For those seeking an exhaustive, company-specific financial breakdown, our "Financial Analysis & Report" offers in-depth insights, combining accurate AI analysis with Paul Borosky, MBA's experienced oversight.

Sincerely,

Paul, MBA.

PDF/Downloadable Version

Click Below for the CURRENT

Downloadable PDF Price!!

Click Below for the CURRENT

Downloadable PDF Price!!

Sample Financial Report

Walmart 2023 - Brief Company Summary

Walmart, the world's largest retailer, is a multinational corporation that operates a chain of hypermarkets, discount department stores, and grocery stores. Founded in 1962 by Sam Walton, Walmart has grown into a household name known for its wide range of products at affordable prices. With its headquarters in Bentonville, Arkansas, Walmart has a vast presence across the globe, serving millions of customers each day.

The company's mission is to help people save money and live better, aiming to provide convenient access to quality goods and services. Walmart offers a diverse selection of merchandise, including groceries, apparel, electronics, home goods, and more. Through its commitment to low prices and a vast network of suppliers, Walmart strives to offer value to its customers while supporting communities and creating economic opportunities.

Walmart embraces innovation and digital transformation, leveraging technology to enhance the shopping experience for customers both in-store and online. With a focus on sustainability, the company aims to reduce its environmental footprint and promote responsible practices throughout its operations.

Overall, Walmart's customer-centric approach, expansive product offerings, and dedication to affordability have made it a prominent player in the global retail industry.

From a financial perspective, as of 2023, Walmart’s market capitalization is $426 billion. The organization’s beta is .5. A beta below 1.0 indicates that the company's stock is less risky as compared to the overall market. Walmart’s current stock price is $156.81. The organization’s current dividend yield is approximately 1.47%. Finally, important competitors for the organization would be Target as well as Amazon.com (6/23).

Walmart Financial Report Sources

"Walmart 2021 Financial Statements and Financial Ratios: Defined, Discussed, and Analyzed for 5 Years” was written by Paul Borosky, MBA., doctoral candidate and owner of Quality Business Plan. In this summarized book, the author researched Walmart's 10k, Walmart's 2017 10k annual report, Walmart's 2021 10k annual report, Walmart's 2020 10k annual report, and Walmart's 2019 10k annual report as the basis for information gathering. Once all Walmart's 10k annual statements were collected, the author then inserted Walmart's income statement information and Walmart's balance sheet information into a customized financial template.

Section 1: Walmart Income Statement Analyzed

In this section, I walk through a broad definition of what an income statement is and why it is important. From this, I then discuss and define income statement line items, such as revenues, gross profits, etc., in detail. After each line item is defined and discussed, I finally offer a summary analysis of Walmart's important income statement line item trends from 2018 to 2023, in most cases.

Revenue Growth:

Walmart’s revenues for the last five years have increased steadily. On average, revenue growth over this time frame was 3.1%. For a multinational organization, this would be considered about average. However, the impressive aspect of its revenue growth would be its consistency in positive growth over this time frame.

Analyst Grade: A

Walmart 2023 Summary Income Statement |

|||||

| Column1 | 2023 | 2022 | 2021 | 2020 | 2019 |

| Revenues | 611,289 | 572,754 | 559,151 | 523,964 | 514,405 |

| COGS | 463,721 | 429,000 | 420,315 | 394,605 | 385,301 |

| Gross Profit | 147,568 | 143,754 | 138,836 | 129,359 | 129,104 |

| SG&A | 127,140 | 117,812 | 116,288 | 108,791 | 107,147 |

| Depreciation | 10,945 | 10,658 | 11,152 | 10,987 | 10,678 |

| R & D | - | - | - | - | - |

| Other | - | - | - | - | - |

| Total Operating Expenses | 138,085 | 128,470 | 127,440 | 119,778 | 117,825 |

| EBIT | 20,428 | 25,942 | 22,548 | 20,568 | 21,957 |

| Other Income | - | - | |||

| Interest Expense | 1,874 | 1,836 | 2,194 | 2,410 | 2,129 |

| EBT | 17,016 | 18,696 | 20,564 | 20,116 | 11,460 |

| Taxes | 5,724 | 4,756 | 6,858 | 4,915 | 4,281 |

| Net Income | 11,680 | 13,673 | 13,510 | 14,881 | 6,670 |

Walmart Balance Sheet Analyzed

For Walmart's balance sheet, I again go through each important line item from the balance sheet. In reviewing each line item, I will define the balance sheet line item, such as cash, property, plant and equipment, and liabilities between 2017 to 2021. Next, I then offer an analysis of Walmart's important balance sheet line item.

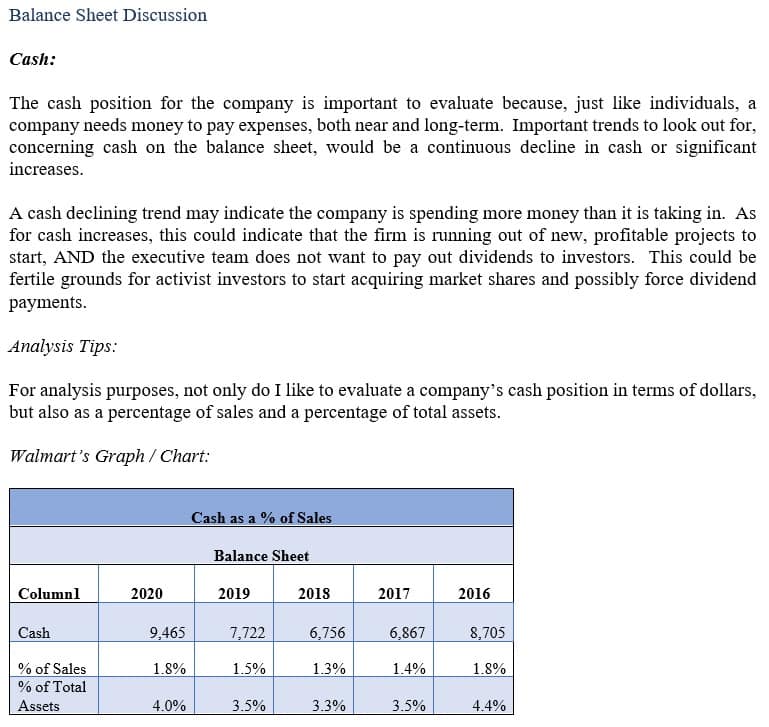

Cash:

Walmart’s cash position between 2018 and 2020 was approximately 1.3 to 1.8% of sales. However, in 2021, the organization’s cash position as compared to sales increased significantly to 3.2% of sales. This increase may have been due to the organization’s concerns about the Covid-19 pandemic and their desire to have an increased cash buffer. Further, this hypothesis may be supported because, in 2022, the organization’s cash position as compared to sales decreased to 2.6% of sales. If this trend continues, then investors should expect a cash position in the future within the range of 1.3% to about 1.8%.

Analyst Grade: A

Walmart 2023 Summary Balance Sheet |

||||||

| Column1 | 2023 | 2022 | 2021 | 2020 | 2019 | |

| Cash | 8,625 | 14,760 | 17,741 | 9,465 | 7,722 | |

| Short Term Investment | - | - | - | - | - | |

| Account Receivable | 7,933 | 8,280 | 6,516 | 6,284 | 6,283 | |

| Inventory | 56,576 | 56,511 | 44,949 | 44,435 | 44,269 | |

| Other | - | - | - | - | - | |

| Current Assets | 75,655 | 81,070 | 90,067 | 61,806 | 61,897 | |

| Net PPE | 100,760 | 94,515 | 92,201 | 105,208 | 104,317 | |

| Goodwill | 28,174 | 29,014 | 28,983 | 31,073 | 31,181 | |

| Other | - | - | - | - | - | |

| Total Assets | 243,197 | 244,860 | 252,496 | 236,495 | 219,295 | |

| Accounts Payable | 53,742 | 55,261 | 49,141 | 46,973 | 47,060 | |

| Accrued Expense | 31,126 | 26,060 | 37,966 | 22,296 | 22,159 | |

| Accrued Taxes | 727 | 851 | 242 | 280 | 428 | |

| Notes Payable | 372 | 410 | 224 | 575 | 5,225 | |

| LT Debt - Current | 4,191 | 2,803 | 3,115 | 5,362 | 1,876 | |

| Other | - | - | - | - | ||

| Total Current Liabilities | 92,198 | 87,379 | 92,645 | 77,790 | 77,477 | |

| LT Debt | 34,649 | 34,864 | 41,194 | 43,714 | 50,203 | |

| Other | - | - | - | - | ||

| Total Liabilities | 159,443 | 152,969 | 164,965 | 154,943 | 50,203 | |

| Common Stock | 5,238 | 5,115 | 3,928 | 3,531 | 3,253 | |

| Treasury | - | - | - | - | - | |

| Retained Earnings | 83,135 | 86,904 | 88,763 | 83,943 | 80,785 | |

| Other | - | - | - | - | - | |

| Total Equity | 83,754 | 91,891 | 87,531 | 81,552 | 79,634 | |

| Total Equity & Liability | 243,197 | 244,860 | 252,496 | 236,495 | 219,295 | |

Walmart's Financial Ratio Summary

For this section, I have chosen several different financial ratios to review for Walmart from 2017 to 2021. In reviewing each of Walmart's financial ratios, I first start with defining the financial ratio. Next, I supply the financial formula for calculating the specific ratio. Finally, I offer a brief analysis of Walmart's Important Financial ratios.

Walmart's Current Ratio:

Walmart’s current ratio has increased from .79 in 2020 to .93 and 2022. The increase in the organization’s current ratio during a pandemic is a smart move, in my opinion. The increased current ratio shows that the firm may be increasing its cash position to ensure liquidity for the short term.

Analyst Grade: A

Walmart's Total Asset Turnover:

Walmart’s total asset turnover ended 2018 at 2.48. In the next four years, the organization would decrease its total asset turnover ending 2021 at 2.21. Fortunately, the organization would improve its asset utilization and end 2022 at a 2.3 total asset turnover. If this trend continues, then it may indicate the company has achieved its cost-cutting objectives over the last several years and is ready to move forward with growth.

Analyst Grade: A-