🚀 Dive Into Apple Inc.'s 2023 Financial World Like a Pro! 📈

Apple Inc. 2023 Beginner’s Guide Introduction:

Hey there, future business moguls! Ready to decode the financial success of Apple Inc. in 2023? Seize our brand-new guide, "Apple Inc. 2023: A Beginner's Guide to Financial Analysis," presented by Quality Business Consultant and penned by the financial sage, Paul Borosky, MBA. This guide is far from your typical yawn-inducing financial read; it's your all-access pass to understanding Apple's financial dynamics in 2023!

Why You'll Love This Guide:

- Crafted by a Finance Rockstar: 🎸 Paul Borosky, MBA, isn't just any finance professor – he's your navigator through the financial cosmos, thanks to Quality Business Consultant.

- Financial Scoop on Apple: 🍏 Dive into Apple's income and balance sheets for 2023 – it's like a financial time capsule! We provide general tips for you to analyze Apple's income statement, balance sheet, and common financial ratios!

- Ratios Galore: 📊 Unravel over twenty financial ratios! These insights could catapult you to financial wizardry status.

- Fun Minus the Jargon: 🎉 Bid farewell to complex jargon with our "In other words" sections, making financial concepts your next cool chat topic.

- Secret Sauce Tips: 📝 Paul shares his elite financial analysis tips, empowering you to showcase your analytical prowess in any setting.

- Bonus Level: 🔑 Explore deeper with our "Company Report" available for purchase – your VIP pass to Apple's financial intricacies!

Guide Highlights:

- Disclaimer (Yep, the necessary legal bit).

- A Forward that's genuinely engaging.

- Income Statements and Balance Sheets, but make them thrilling.

- Financial Ratios: Decode financial excellence like a pro.

- Plus, a treasure trove of financial insights!

Table of Contents Sneak Peek:

- Income Statement Insights: Dive into the details of revenue, expenses, and everything in between.

- Balance Sheet Breakdown: Decode assets, liabilities, and equity – the core of financial analysis.

- Ratios Unleashed: Master the art of financial ratios from Current Ratios to Debt Ratios.

Who's This For?

Aimed at college business enthusiasts and budding entrepreneurs alike, this guide is your trusty sidekick in the realm of financial analysis.

Snag Your Copy:

Step up your financial game! Secure your digital copy of "Apple Inc. 2023: A Beginner's Guide to Financial Analysis" and transform those daunting financial statements into your playground.

Paul, MBA.

Additional Note: Our beginner's guide focuses on imparting a general understanding of crucial financial topics, including income statements, balance sheets, and the pivotal financial ratios for their analysis. It provides a summarized version of Apple's income statement and balance sheet, alongside the necessary calculations and ratios specific to the company. In this guide, the hands-on financial analysis is yours to undertake, armed with the right tools. For those seeking detailed, company-specific financial analysis, our "Financial Analysis & Report" delivers comprehensive insights, blending AI-powered analysis with Paul Borosky, MBA's expert review.

PDF/Downloadable Versions

Click Below for the CURRENT

Downloadable PDF Price!!

Click Below for the CURRENT

Downloadable PDF Price!!

Sample Financial Report

***Summary analysis is not included in the "Beginner's Guide" version.

Apple Inc.: Brief Summary

Apple Inc. is a globally renowned technology company headquartered in Cupertino, California. Founded in 1976 by Steve Jobs, Steve Wozniak, and Ronald Wayne, Apple has grown into one of the world's most influential and valuable companies. The company's iconic products, including the iPhone, iPad, Macintosh computers, and Apple Watch, have revolutionized the consumer electronics industry and set new standards for design and innovation.

Apple's success is rooted in its commitment to delivering exceptional user experiences through cutting-edge hardware, software, and services. The iOS and macOS operating systems provide seamless integration across Apple devices, fostering brand loyalty and ecosystem lock-in. The company's App Store is a thriving marketplace for third-party developers, offering users a vast array of apps and services worldwide.

Financially, Apple has consistently demonstrated strength and resilience. It boasts a market capitalization that frequently ranks it as the most valuable publicly traded company globally. Its robust revenue streams come from a diverse portfolio that includes hardware sales, subscription services like Apple Music and Apple TV+, and digital content distribution through iTunes.

Apple's commitment to sustainability and corporate responsibility is evident in its efforts to reduce its carbon footprint and improve labor conditions within its supply chain. Tim Cook, the company's current CEO, has overseen Apple's continued growth and expansion into new markets, including wearables and services, ensuring that the company remains at the forefront of technological innovation. Apple's enduring legacy is a testament to its ability to blend design, technology, and business acumen to shape the modern digital landscape (10/23).

Apple Financial Report Sources

The sources for the Apple Financial Report authored by Paul Borosky, MBA and owner of Quality Business Plan, include “A Beginner’s Guide to Analyzing Apple’s Financial Statements and Financial Ratios” and “Apple Inc. Financial Report with AI Financial Analysis Insights.” These reports are based on a thorough analysis of Apple’s financial statements from various years, including the 2022 10k, 2021 10k annual report, 2020 10k annual report, 2019 10k annual report, and 2018 10k annual report. These sources are the foundation for gathering the necessary information to provide comprehensive insights into Apple’s financial performance and ratios.

Snipits From Apple Inc. Financial Report by Paul Borosky, MBA.

Section 1: Apple Inc. Income Statement Analyzed

This section comprehensively explains the income statement, highlighting its significance in financial analysis. The importance of each income statement line item, such as revenues, gross profits, and more, is discussed in detail. A thorough understanding of Apple’s income statement is achieved by defining and delving into each line item.

Importance of Apple Inc. Income Statement for Financial Analysis:

A summary analysis of Apple’s significant income statement trends is presented after discussing income statement line items. This analysis provides critical insights into the company’s revenue generation, profitability, and cost management over a specified period. By examining the trends in each line item, analysts can identify patterns, strengths, and potential areas for improvement in Apple’s financial performance.

This section is valuable for understanding Apple’s income statement, interpreting its line items, and gaining insights into its financial health and operational efficiency. The summary analysis of income statement trends enhances the overall financial analysis and aids in making informed decisions regarding investment, financial planning, and business strategies related to Apple Inc.

Apple 2023 Summary Income Statement |

|||||

| Column1 | 2023 | 2022 | 2021 | 2020 | 2019 |

| Revenues |

383,285 |

394,328 | 365,817 | 274,515 |

260,174 |

| COGS |

214,137 |

223,546 | 212,981 | 169,559 |

161,782 |

| Gross Profit |

169,148 |

170,782 | 152,836 | 104,956 |

98,392 |

| SG&A |

24,932 |

25,094 | 21,973 | 19,916 |

18,245 |

| Depreciation |

11,519 |

11,104 | 11,284 | 11,056 |

12,547 |

| R & D |

29,915 |

26,251 | 21,914 | 18,273 |

16,217 |

| Other | - | - | - | - | |

| Total Operating Expenses |

54,847 |

51,345 | 43,887 | 38,668 |

34,462 |

| EBIT |

114,301 |

119,437 | 108,949 | 66,288 |

63,930 |

| Other Income |

(565) |

(334) | 258 | 803 |

1,807 |

| Interest Expense | - | - | - | - | - |

| EBT |

113,736 |

119,103 | 109,207 | 67,091 |

65,737 |

| Taxes |

16,741 |

19,300 | 14,527 | 9,680 |

10,481 |

| Net Income |

96,995 |

99,803 | 94,680 | 57,411 |

55,256 |

Importance of Apple’s Income Statement for Financial Analysis

The income statement of Apple Inc. plays a crucial role in financial analysis as it provides essential insights into the company’s revenue, expenses, and profitability. Analyzing Apple’s income statement is significant for several reasons. Firstly, it allows for a thorough assessment of the company’s revenue sources, enabling analysts to evaluate its sales performance and revenue growth over time. Secondly, it helps assess Apple’s profitability by examining gross profit, operating income, and net income, providing an understanding of the company’s ability to generate profits and maintain healthy margins. Additionally, the income statement enables evaluation of Apple’s expense management, cost control strategies, and resource efficiency—comparisons with industry peers and historical data aid in benchmarking and tracking performance. Furthermore, the income statement is a foundation for forecasting, decision-making, financial planning, and investment analysis. Understanding and analyzing Apple’s income statement is essential for assessing financial health, profitability, and growth potential.

Sample: Revenue Growth for Apple:

Apple's revenue in 2023 was $383,285 million, slightly decreasing from $394,328 million in 2022, marking a 2.8% revenue growth. This decline contrasts with the steady growth observed in previous years: a 7.8% increase from 2021 to 2022, a significant 33.3% jump from 2020 to 2021, and a 5.5% rise from 2019 to 2020. The 2020 to 2021 growth was particularly notable, suggesting a solid recovery or growth phase for Apple. The recent decrease in 2023 could indicate various factors affecting Apple's financial performance, such as market saturation, increased competition, economic factors, or changes in consumer behavior. The overall trend shows Apple's ability to grow significantly over the years, with 2023 being an exception to this pattern.

AI Analyst Grade: B

Considering the overall financial performance of Apple from 2019 to 2023, I would assign a letter grade of "B." This grade reflects Apple's strong revenue growth in 2020 and 2021, particularly the global 33.3% increase during a challenging economic period. However, the slight revenue decrease in 2023 prevents a higher grade, indicating some challenges or a potential plateau in growth. Despite this recent downturn, Apple has demonstrated substantial resilience and capacity for growth over these years. The "B" grade balances these aspects of their financial performance.

Section 2: Apple Inc. Balance Sheet Analyzed

A detailed examination of each significant line item is conducted to analyze Apple Inc.’s balance sheet. This involves defining Apple’s balance sheet components, including cash, property, plant and equipment, and liabilities. Each line item is thoroughly reviewed to understand Apple’s financial position comprehensively. Following the definition and discussion of each line item, a summary analysis of Apple’s important balance sheet components is presented. This analysis offers valuable insights into the company’s asset structure, liabilities, and overall financial health. By assessing the balance sheet line items, analysts can identify strengths, weaknesses, and potential areas of improvement within Apple’s financial position. Analyzing Apple’s balance sheet is crucial in evaluating the company’s solvency, liquidity, and long-term stability.

Apple 2023 Summary Balance Sheet |

|||||

| Column1 | 2023 | 2022 | 2021 | 2020 | 2019 |

| Cash | 29,965 | 23,646 | 34,940 | 38,016 | 48,844 |

| Short Term Investment | 31,590 | 24,658 | 27,699 | 52,927 | 51,713 |

| Account Receivable | 29,508 | 28,184 | 26,278 | 16,120 | 22,926 |

| Inventory | 6,331 | 4,946 | 6,580 | 4,061 | 4,106 |

| Other | - | - | - | - | - |

| Current Assets | 143,566 | 135,405 | 134,836 | 143,713 | 162,819 |

| Net PPE | 43,715 | 42,117 | 39,440 | 36,766 | 37,378 |

| Goodwill | - | - | - | - | - |

| Other | - | - | - | ||

| Total Assets | 352,563 | 352,755 | 351,002 | 323,888 | 338,516 |

| Accounts Payable | 62,611 | 64,115 | 54,763 | 42,296 | 46,236 |

| Accrued Expense | - | - | - | - | - |

| Accrued Taxes | - | - | - | - | - |

| Notes Payable | 5,985 | 9,982 | 6,000 | 4,996 | 5,980 |

| LT Debt - Current | 9,822 | 11,128 | 9,613 | 8,773 | 10,260 |

| Other | - | ||||

| Total Current Liabilities | 145,308 | 153,982 | 125,481 | 105,392 | 105,718 |

| LT Debt | 95,281 | 98,959 | 109,106 | 98,667 | 91,807 |

| Other | |||||

| Total Liabilities | 290,437 | 302,083 | 287,912 | 258,549 | 248,028 |

| Common Stock | 73,812 | 64,849 | 57,365 | 50,779 | 45,174 |

| Treasury | - | - | - | - | - |

| Retained Earnings | (214) | (3,068) | 5,562 | 14,966 | 45,898 |

| Other | |||||

| Total Equity | 62,146 | 50,672 | 63,090 | 65,339 | 90,488 |

| Total Equity & Liability | 352,563 | 352,755 | 351,002 | 323,888 | 338,516 |

Importance of Apple’s Balance Sheet for Financial Analysis

Apple's balance sheet is a crucial document in financial analysis because it gives us a snapshot of the company's financial situation at a specific time. It's essential to understand why this balance sheet matters.

Firstly, it helps us determine if Apple has enough money to cover its short-term bills and handle financial difficulties. We do this by looking at what the company owns (its assets) and what it owes (its liabilities).

Secondly, the balance sheet shows us how Apple funds its operations—whether using a lot of borrowed money or relying on its own equity. This information helps us assess how stable and risky Apple's financial situation is.

Additionally, the balance sheet is handy for comparing how Apple's financial position changes over time and looking at trends. It's like tracking your bank account balance over several months to see if you're saving or spending more.

Lastly, the balance sheet is the starting point for calculating other financial measures and ratios that give us a more complete picture of Apple's financial health and long-term viability. So, understanding Apple's balance sheet is crucial in evaluating its financial well-being, risk level, and ability to thrive in the long run.

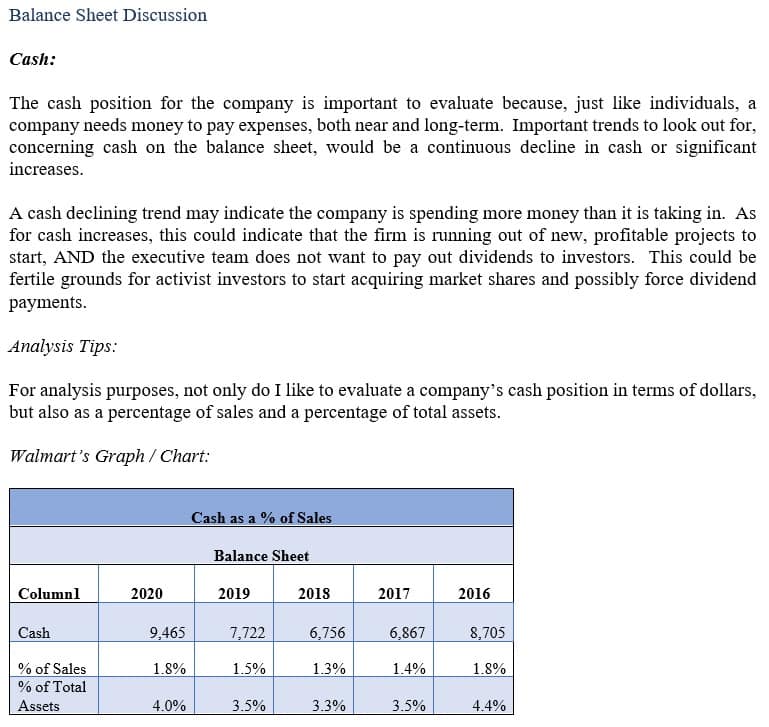

Cash.

Apple's cash position as a percentage of sales has decreased from 2019 to 2023. In 2019, cash represented 18.8% of sales, the highest in the five years. This percentage steadily decreased to 13.8% in 2020, 9.6% in 2021, and 6.0% in 2022 before slightly increasing to 7.8% in 2023.

Similarly, when looking at cash as a percentage of total assets, there is a decline from 14.4% in 2019 to 8.5% in 2023. This trend suggests a change in Apple's asset composition and liquidity management, possibly indicating a strategic shift towards investing more in assets other than cash or an increase in total assets outpacing the growth in cash. Given the significant decrease over the period and the recent minor increase, I would assign a grade of "C+" for Apple's cash management as a percentage of sales from 2019 to 2023, reflecting a need for potential improvement in liquidity management.

Analyst Grade: C+

Section 3: Apple Inc. Financial Ratios Analyzed

In Section 3, a comprehensive analysis of Apple Inc.’s financial ratios is conducted. This analysis focuses on several key financial ratios specifically chosen for Apple Inc. The section begins by providing explicit definitions of each financial ratio selected. This ensures a thorough understanding of the ratio’s purpose and calculation methodology.

The financial formulas necessary for computing each specific ratio are then presented. This enables readers to apply the formulas to their analysis or evaluation of Apple Inc. Finally, a concise analysis of Apple’s critical financial ratios is provided. This analysis highlights the significance of each ratio, offering insights into Apple’s financial performance and position. By reviewing and understanding these financial ratios, stakeholders can make informed decisions and assessments regarding Apple Inc.’s financial health, efficiency, profitability, and overall success in the market.

Importance of Apple's Financial Ratios for Financial Analysis

Apple's financial ratios are vital tools in financial analysis, offering critical insights into the company's fiscal health and performance. These ratios are indispensable for assessing Apple's profitability, efficiency, liquidity, and solvency. Metrics like return on assets (ROA), return on equity (ROE), and gross profit margin help gauge how well Apple generates profits and manages its resources.

Financial ratios also aid in benchmarking Apple's performance against industry peers and historical data, providing context and revealing trends, highlighting areas of strength and potential weakness.

Furthermore, they assist in investment decisions by providing a clear picture of Apple's risk profile and ability to meet short-term and long-term obligations. Ratios like the debt-to-equity ratio and interest coverage ratio offer insights into the company's financial stability.

In conclusion, Apple's financial ratios are indispensable for investors, analysts, and stakeholders. They guide informed decision-making, assess the company's financial health, and help understand its competitive position in the ever-evolving tech industry.

Apple’s Current Ratio:

Apple's Current Ratio, which measures the company's ability to pay short-term obligations, has decreased from 2019 to 2023. 2019, the current ratio was 1.54, indicating a solid liquidity position. This ratio decreased to 1.36 in 2020 and 1.07 in 2021.

In 2022, the current ratio declined to 0.88, suggesting tighter liquidity, before slightly recovering to 0.99 in 2023. The declining trend, especially in 2022 and 2023, indicates that Apple's current assets are nearly equivalent to its current liabilities, which could signal potential short-term liquidity challenges. Given this decreasing trend and the recent recovery, I would assign a grade of "C" for Apple's management of the current ratio from 2019 to 2023. This grade reflects the need for improvement in maintaining more robust short-term liquidity.

Analyst Grade: C