🚀 Lace Up for a Deep Dive into Nike's 2023 Financial Performance! 📊

Nike 2023 Beginner’s Guide Introduction:

Welcome, finance aficionados! Are you set to sprint through the financial scorecard of Nike in 2023? Embark on your journey with "Nike 2023: Beginner's Guide to Financial Analysis," your essential playbook brought to you by Quality Business Consultant, with insights from finance whiz Paul Borosky, MBA. This guide is more than just numbers; it's your strategic guide to analyzing the fiscal health of one of the leading names in the athletic apparel and footwear industry!

Why You'll Love This Guide:

- Expert Financial Coaching: 🎓 Navigate the financial tracks of Nike in 2023 with Paul Borosky, MBA, from Quality Business Consultant.

- Summary Financial Breakdown: 📉 Examine Nike's income statements and balance sheets for 2023, so you can understand the nuts and bolts of their financial stance.

- Comprehensive Ratio Analysis: 🧮 Engage with over twenty crucial financial ratios to evaluate Nike's economic fitness and market standing.

- Simplified Financial Lingo: 📚 "In other words" sections that break down complex financial jargon into simple, actionable insights.

- Personalized Analysis Tips: 💡 Utilize Paul's targeted tips to boost your financial analysis skill set, applicable in both academic settings and the business world.

- Extended Insights with In-Depth Report: 🔍 Go the extra mile with our "Financial Analysis & Report" for a comprehensive look at Nike, blending AI-driven data with Paul Borosky's seasoned analysis.

Guide Highlights:

- A friendly Legal Disclaimer

- An engaging Forward to get you warmed up for financial analysis

- In-depth exploration of Income Statements and Balance Sheets for 2023

- Detailed examination of Financial Ratios to enhance your understanding and analysis

- A treasure trove of financial insights awaits!

Table of Contents Sneak Peek:

- Income Statement Exploration: Running through revenue, costs, and profitability

- Balance Sheet Insights: Jumping into assets, liabilities, and equity – the core of financial stability

- Financial Ratios Decoded: Equipping you with the knowledge to gauge Nike's financial pace

Who's This For?

Ideal for energetic business students and budding entrepreneurs, this guide is your ticket to mastering financial analysis with a focus on Nike.

Kickstart Your Financial Expertise:

Enhance your financial literacy with "Nike 2023: Beginner's Guide to Financial Analysis." Turn complex financial reports into a track for strategic decision-making.

Additional Note: This beginner's guide aims to lay a solid foundation in essential financial concepts, focusing on income statements, balance sheets, and key financial ratios for their analysis. It provides a concise overview of Nike's 2023 financials, offering specific data, calculations, and ratios to guide your analytical process. While the guide provides the tools for exploration, the in-depth financial analysis is your challenge to undertake. For those seeking a detailed, company-specific financial overview, our "Financial Analysis & Report" offers thorough insights, combining AI precision with Paul Borosky, MBA's expert review.

Sincerely,

Paul, MBA.

PDF/Downloadable Versions

Click Below for the CURRENT

Downloadable PDF Price!!

Click Below for the CURRENT

Downloadable PDF Price!!

Sample Financial Report

Nike: Brief Summary

Nike Inc. designs creates and sells sportswear such as sneakers, clothing, sporting equipment, and other athletic-type products. Nike's headquarters in the US is at One Bowerman Dr. in Beaverton, OR. 97005. The company competes in the customer cyclical business sector. As for the industry, the organization competes in the footwear and accessories industry. At present, Nike employs about 73,000 individuals.

Nike Financial Report Sources

“Nike 2022 Financial Report: Financial Statements and Financial Ratios: Defined, Discussed, and Analyzed for 5 Years” was written by Paul Borosky, MBA., and owner of Quality Business Plan. In this report, I used Nike's 2018 10k, Nike's 2017 10k annual report, 2021 10k annual report, 2020 10k annual report, and Nike's 2019 10k annual report as the basis for information gathering.

Section 1: Nike Income Statement Analyzed

In this section, I walk through a broad definition of what an income statement is and why it is important. From this, I then discuss and define income statement line items, such as revenues, gross profits, etc. in detail. After each line item is defined and discussed, I finally offer a summary analysis of Nike's important income statement line item trends.

Nike Revenue Growth.

Nike's revenues in 2018 were $36.3 billion. In 2022, their revenues were $46.7 billion. This is an average growth rate annually of about 6.8% for the last five years. This trend indicates the organization has entered the mature phase of its business cycle. Further, the company is doing an excellent job of continually and systematically growing revenues, except for a dip in 2020.

Analyst Grade: A

Nike Summary Income Statement 2021 |

|||||

|

2021 |

2020 | 2019 | 2018 |

2017 |

|

| Revenues |

44,538 |

37,403 | 39,117 | 36,397 |

34,350 |

| COGS |

24,576 |

21,162 | 21,643 | 20,441 |

19,038 |

| Gross Profit |

19,962 |

16,241 | 17,474 | 15,956 |

15,312 |

| SG&A |

13,025 |

13,126 | 12,702 | 11,511 |

10,563 |

| Depreciation |

744 |

721 | 705 | 747 |

706 |

| R & D | - | - | - | - | |

| Other | - | - | - | - | |

| Total Operating Expenses |

13,769 |

13,847 | 13,407 | 12,258 |

11,269 |

| EBIT |

6,923 |

2,976 | 4,850 | 4,379 |

4,945 |

| Other Income | - | - | - | ||

| Interest Expense |

262 |

89 | 49 | 54 |

59 |

| EBT |

6,661 |

2,887 | 4,801 | 4,325 |

4,886 |

| Taxes |

934 |

348 | 772 | 2,392 |

646 |

| Net Income |

5,727 |

2,539 | 4,029 | 1,933 |

4,240 |

Section 2: Nike Balance Sheet Analyzed

For Nike's balance sheet, I again go through each important line item from the balance sheet. In reviewing each line item, I will define Nike's balance sheet line items, such as cash, property, plant and equipment, and liabilities. Next, I then offer a summary analysis of Nike's important balance sheet line items.

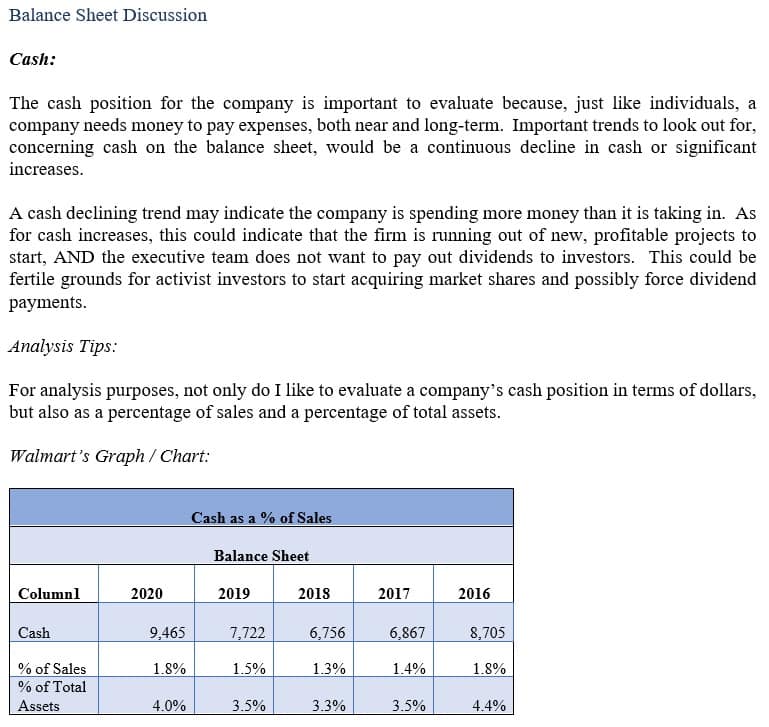

Nike's Cash.

Nike's cash holding in 2018 was $4.2 billion, or 11.7% of sales. In 2022, their cash position was $8.5 billion, or 18.4% of sales. This trend indicates that the organization has felt the need to increase its cash position as compared to sales year-over-year. This increase lowers the organization's ability to fully utilize its cash for growth or other revenue-generating opportunities. From an investor's perspective, this is not a good trend.

Analyst Grade: B

Nike 2021 Summary Balance Sheet |

|||||

|

2021 |

2020 | 2019 | 2018 |

2017 |

|

| Cash |

9,889 |

8,348 | 4,466 | 4,249 |

3,808 |

| Short Term Investment |

3,587 |

439 | 197 | 996 |

2,371 |

| Account Receivable |

4,463 |

2,749 | 4,272 | 3,498 |

3,677 |

| Inventory |

6,854 |

7,367 | 5,622 | 5,261 |

5,055 |

| Other | - | - | - | - | |

| Current Assets |

26,291 |

20,556 | 16,525 | 15,134 |

16,061 |

| Net PPE |

4,904 |

4,866 | 4,744 | 4,454 |

3,989 |

| Goodwill |

242 |

223 | 154 | 154 |

139 |

| Other | - | - | - | - | |

| Total Assets |

37,740 |

31,342 | 23,717 | 22,536 |

23,259 |

| Accounts Payable |

2,836 |

2,248 | 2,612 | 2,279 |

2,048 |

| Accrued Expense |

6,063 |

5,184 | 5,010 | 3,269 |

3,011 |

| Accrued Taxes |

306 |

156 | 229 | 150 |

84 |

| Notes Payable |

2 |

248 | 9 | 336 |

325 |

| LT Debt - Current | - |

3 |

6 | 6 |

6 |

| Other | - | - | - | - | |

| Total Current Liabilities |

9,674 |

8,284 | 7,866 | 6,040 |

5,474 |

| LT Debt |

9,413 |

9,406 | 3,464 | 3,468 |

3,471 |

| Other | - | - | - | - | |

| Total Liabilities |

24,973 |

23,287 | 14,677 | 12,724 |

10,852 |

| Common Stock |

9,968 |

8,302 | 7,163 | 6,384 |

8,638 |

| Treasury | - | - | - | - | - |

| Retained Earnings |

3,179 |

(191) | 1,643 | 3,517 |

3,979 |

| Other | - | - | - | - | |

| Total Equity |

12,767 |

8,055 | 9,040 | 9,812 |

12,407 |

| Total Equity & Liability |

37,740 |

31,342 | 23,717 | 22,536 |

23,259 |

Section 3: Nike Financial Ratios Analyzed

For this section, I have chosen several different financial ratios to review for Nike. In reviewing each of Nike's financial ratios, I first start with defining the financial ratio. Next, I supply the financial formula for calculating the specific ratio. Finally, I offer a brief analysis of Nike's Important Financial ratios.

Nike Current Ratio:

Nike's current ratio was 2.7 in 2021. As of 2022, their current ratio was 2.63. This trend indicates the organization has lowered its current asset holdings as compared to current liabilities. From an investor perspective, this trend should be considered good. However, the organization is still holding an excessive amount of current assets as compared to current liabilities. A better strategy would be for the organization to reduce its current ratio to closer the 1.0.

Analyst Grade: C

Nike Total Asset Turnover:

Nike's total asset turnover in 2019 was 1.65. In 2022, their total asset turnover was 1.16. This trend indicates the organization is continually underutilizing total assets under management. This trend should be concerning from an investor's perspective. To mitigate this issue, the organization should optimize operations to better align assets with revenue generation.

Analyst Grade: B

Nike 2021 Liquidity Ratios |

|||||

| Ratios |

2021 |

2020 | 2019 | 2018 |

2017 |

| Current Ratio |

2.72 |

2.48 |

|||

| Cash Ratio |

1.39 |

1.06 |

|||

| Quick Ratio |

2.01 |

1.59 |

|||

| Net Working Capital |

16,617 |

12,272 |

|||

Nike 2021 Asset Utilization |

|||||

| Ratios |

2021 |

2020 | 2019 | 2018 |

2017 |

| Total Asset Turnover |

1.18 |

1.19 |

|||

| Fixed Asset Turnover |

9.08 |

7.69 |

|||

| Days Sales Outstanding |

29.55 |

34.26 |

|||

| Inventory Turnover (Using Sales) |

6.26 |

5.76 |

|||

| Inventory Turnover (Using COGS) |

3.46 |

3.26 |

|||

| Accounts Receivable Turnover |

12.35 |

10.65 |

|||

| Working Capital Turnover |

2.68 |

3.05 |

|||

| AP Turnover |

9.47 |

9.43 |

|||

| Average Days Inventory |

105.60 |

112.02 |

|||

| Average Days Payable |

38.56 |

38.72 |

|||

Nike 2021 Profitability Ratios |

|||||

| Ratios |

2021 |

2020 | 2019 | 2018 |

2017 |

| Return on Assets |

15.17% |

8.10% |

|||

| Return on Equity |

44.86% |

31.52% |

|||

| Net Profit Margin |

12.86% |

6.79% |

|||

| Gross Profit Margin |

44.82% |

43.42% |

|||

| Operating Profit Margin |

15.54% |

7.96% |

|||

| Basic Earning Power |

18.34% |

9.50% |

|||

| ROCE |

24.67% |

12.91% |

|||

| Capital Employed |

28,066 |

23,058 |

|||

| ROIC |

26.83% |

14.78% |

|||

Nike 2021 Debt Ratios |

|||||

| Ratios |

2021 |

2020 | 2019 | 2018 |

2017 |

| Debt Ratio |

24.95% |

30.81% |

|||

| Debt/Equity |

73.74% |

119.89% |

|||

| Times Interest Earned |

26.42 |

33.44 |

|||